Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

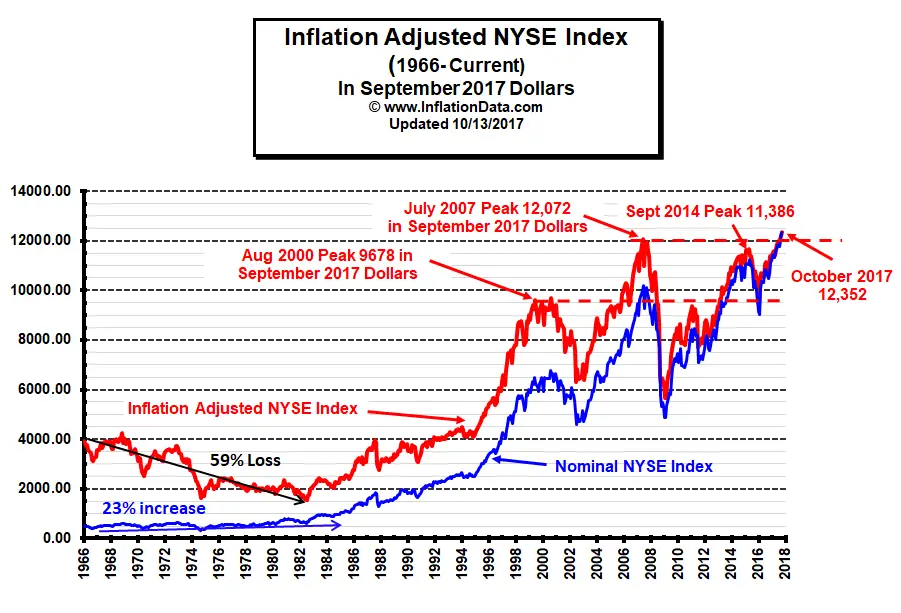

Not sure I follow. Inflation causes increases in company costs (labor, materials), which reduces EPS. If stock prices were to remain constant OR rise in that scenario, P/E ratios would become even further stretched than they already are. And by all measures - CAPE 10, Buffet ratio and many others, we're sitting at least at 2X+ "normal" at these levels.

Curious to hear more on how inflationary pressures are good for stock valuations, especially compared to historical levels. Maybe I'm just missing something..

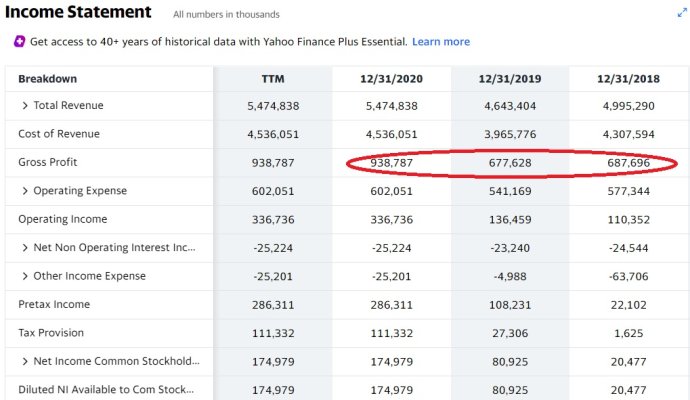

Companies pass on the costs to consumers eventually. The dollar buys less, the E in P/E goes up, even if that E can't buy as much as it used to, the P/E number goes down.

And there is obviously demand there, even at the higher prices. Look at lumber...people are willing to pay 300% inflation in just one year....you think they won't still buy toilet paper if it costs 10% to 15% more?