Vincenzo Corleone

Full time employment: Posting here.

- Joined

- Jul 20, 2005

- Messages

- 617

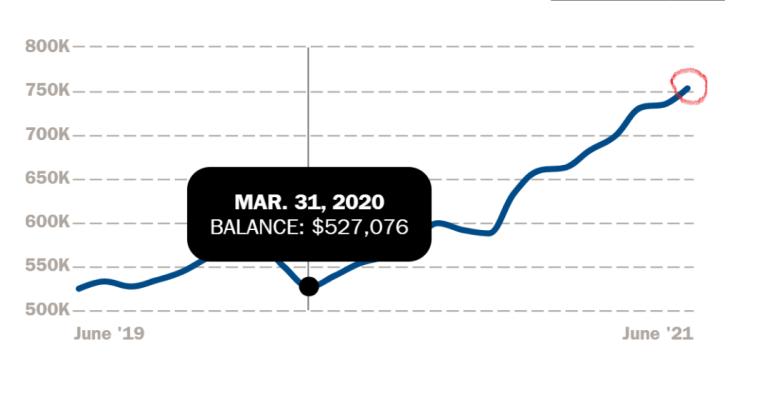

As I mentioned in the above quote a mere four months ago, my total net worth (including the value of my home) hit $5 million for the first time. Well, here I am again to report that my investable net worth has now also reached $5 million!Since my home has a market value of just under $400k, that means that my investable NW has soared by roughly $100k/month recently. Pretty amazing to contemplate these kinds of numbers.

Amazing, indeed! Congrats!