Digital Nomad

Dryer sheet wannabe

I have been doing a lot of research into Growth Mutual Funds. I found one fund offered by a large financial company that has done just great during the last 20 years, (except in 2002-2003 and 2008- of course.)

I have spent hours evaluating the results of this Growth Mutual Fund against its peers (other Large Growth Mutual Funds) and over 90% of the time it beats the competition year after year.

I know past performance does not guarantee future results and history is in the past but if investors in this fund used this philosophy each of the last 20 years they would be disappointed. This Fund just does better than its peers year after year after year after year!

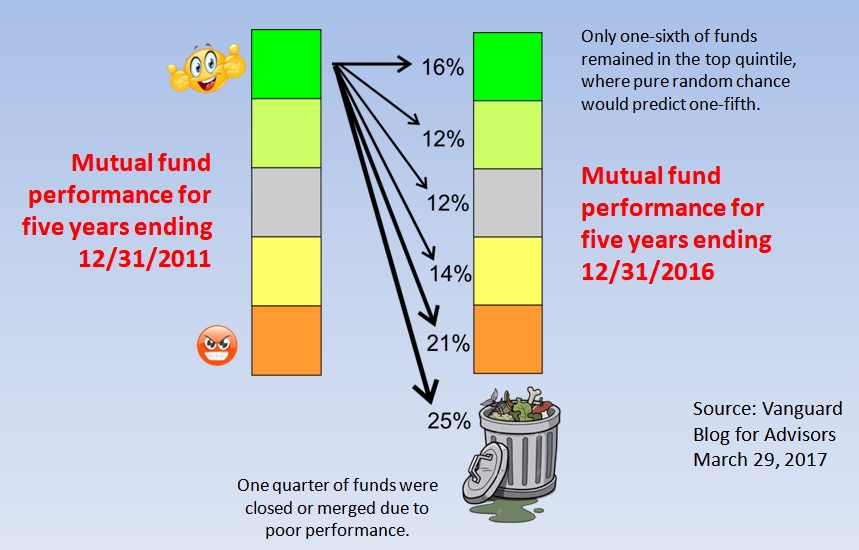

Maybe history is an indicator of the future and certain financial companies and fund managers are just better than others in picking stocks. So if a Mutual Fund did better than its peers year after year after year, would you assume that there is a better than 50/50 chance it will continue to beat most of its peers in 2022?

I have spent hours evaluating the results of this Growth Mutual Fund against its peers (other Large Growth Mutual Funds) and over 90% of the time it beats the competition year after year.

I know past performance does not guarantee future results and history is in the past but if investors in this fund used this philosophy each of the last 20 years they would be disappointed. This Fund just does better than its peers year after year after year after year!

Maybe history is an indicator of the future and certain financial companies and fund managers are just better than others in picking stocks. So if a Mutual Fund did better than its peers year after year after year, would you assume that there is a better than 50/50 chance it will continue to beat most of its peers in 2022?

Last edited:

Yeah.. right

Yeah.. right