To each their own, but I would hate, hate, hate to be tied to adjusting my spending based on how the market did that year. Maybe this is the year to spend extra money on something that I won't get a chance to do later (or really should do now)? I should bypass that, if the market took a dip?

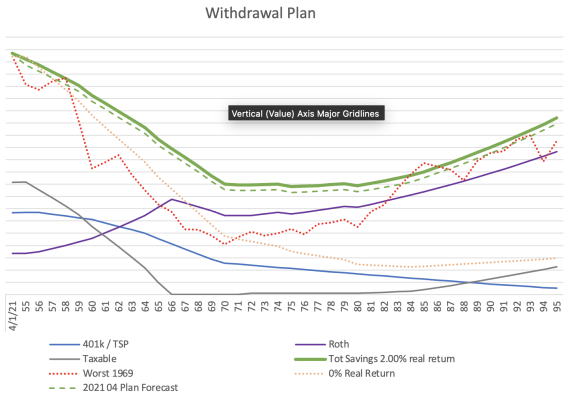

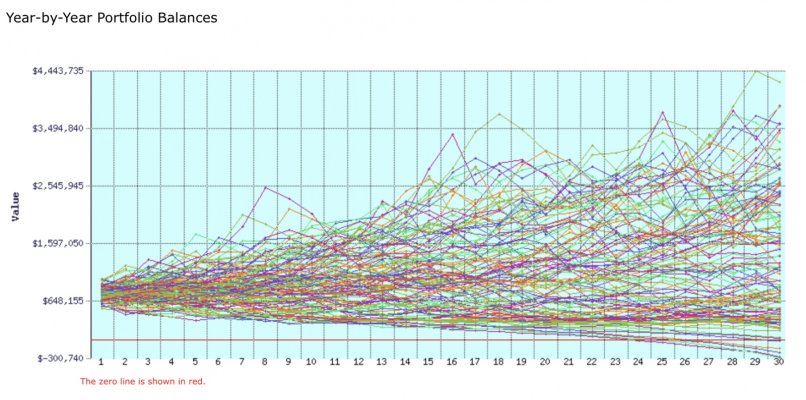

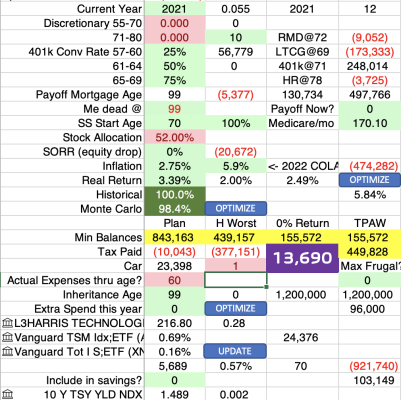

To me, that's the power of a FIRECalc/Trinity-type analysis. A conservative w/d will survive the dips, w/o needing to adjust. Of course, my spending will vary year to year with needs/wants, but I check to make sure that on average, I've got a historically safe WR.

Or just re-evaluate. Like, subtract the extra planned spending from the portfolio, and if my planned future average WR is still conservative (because the portfolio has grown), then I feel I'm good to go.

-ERD50