.

Digital payments are at the core of everything crypto, and a digital asset sponsored by the US Central Bank both questions and challenges the need for privately sponsored synthetic alternatives like Bitcoin and Ethereum. In addition, if adapted, this brings digital coins into the fold of monetary regulation, instead of out in the weeds where it is today.

I read it last night. A few additional perspectives:

1) Institutional and other mainstream investors are begging for a clear US regulation regime, which would let them confidently move into digital assets, as many want to do to add to their asset mix

2) Other countries are setting up clear ground rules, such as Germany, Switzerland, Canada, even the Bahamas, and are enjoying the jobs and capital inflows of the new industry. Other countries, like Russia, China and possibly India, are trying to shut it down, and could become poorer as a result. The US is incentivized to retain its leadership in digital assets by not letting other advanced countries get ahead of it. Of course, it’s a difficult and delicate proposition for the world’s leading economy and reserve currency to get this right, so it is good that the Fed is not rushing to issue a centralized, regulated, official, dollar-denominated stable coin. Chair Powell has not promised a CBDC, but the US exists in a competitive globe, so it’s probably a matter of time.

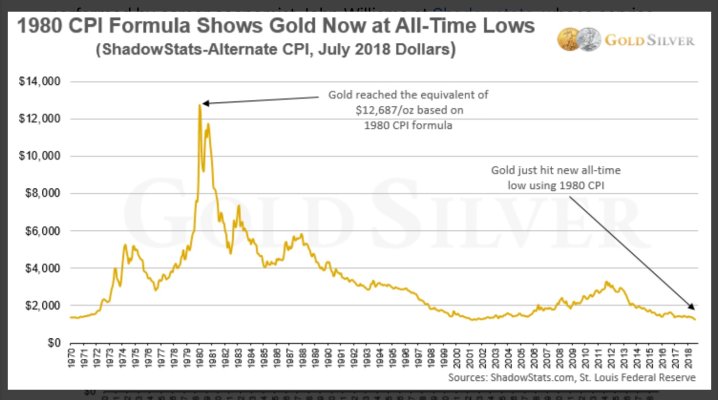

3) I don’t agree with your opinion that this means anything bad for fixed supply, proof of work-based Bitcoin. It is digital property, which is lightly-traded, and has global demand well beyond US control. It is really very different than the thousands of proof of stake, unlimited supply altcoins with specialized uses in games and what not, NFTs, unofficial stable coins and the rest of the digital asset space, much of which will and should be regulated out of existence in the US as “securities”. Bitcoin property can sit just fine right alongside the dollar, stocks, bonds, gold and whatever else. What Bitcoin threatens most at this stage is gold and also weak, hyper-inflating currencies around the world, entailing huge populations whose pesos, Bolivars and dinars are melting far faster than the dollar is melting. Those folks face inflation problems we cannot imagine, and Bitcoin provides them the possibility of a life raft. An official US stable coin would function the same, except we know the dollar is melting too, only slower than other currencies, while there will only ever be 21 million Bitcoin. Will one win out or will both thrive? My hunch is that Fed stable coins will someday be great for short term, high-velocity transactions globally, while Bitcoin will be popular for long-term, lower-velocity value storage.