daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

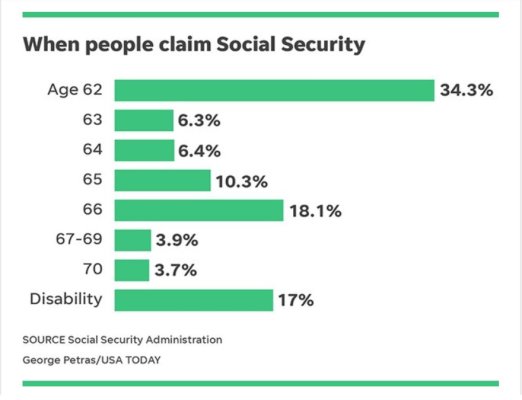

We took SS at 62 and pensions at 55. Even with taking them all as early as possible, combined they cover most of our retirement expenses, so we can let the portfolio grow for our kids. Numbers wise, when to take SS has a pretty low impact on our retirement funding, compared to other actions we've taken like shopping at Grocery Outlet instead of the local supermarkets and joining seat filler programs.