Markola

Thinks s/he gets paid by the post

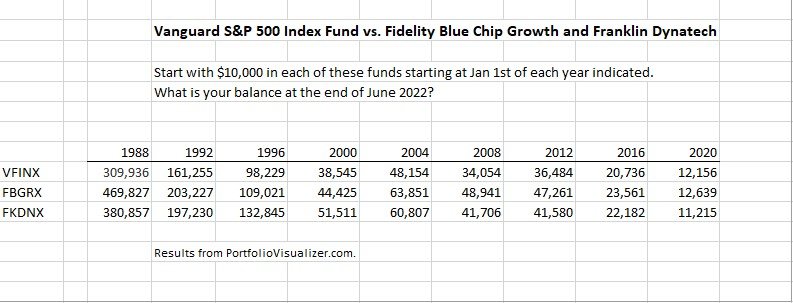

^^^^^ Nah, it’s a game that cannot be won for more than one or two random years in a row, even for highly-paid and highly-caffeinated full-time math majors with avalanches of data and computers the size of your house. Happily, history shows that you, yes, YOU, can crush them all over any 5 year+ period by buying a few cheap index funds, leaving them alone and living your life. Over any 10 year period, your complete, utter triumph over fee and tax-ladened active investors who have made unforced errors is so dominant, it’s not even worth watching the game anymore.

Last edited: