You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Treasury Bills, Notes, and Bonds Discussion

- Thread starter jazz4cash

- Start date

- Status

- Not open for further replies.

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

You stated "My thought is I would rather lock in a known rate than an unknown rate."

There is your answer and I agree with it myself. And I don't believe you're missing anything.

I agree also.

I was waiting for CD rates to hit 4% for a 5 year term and then I was going to start buying. I noticed today that I can buy secondary market Treasury notes through Vanguard for slightly over 4% but that the 4% CDs are callable. So, treasuries seems like a better deal. They cannot be called and they are better protected (although FDIC CDs are very safe).

I quickly perused the above threads to try and understand New vs Secondary. As I understand it, I can lock in the 4% rate today on the secondary or I can buy at auction but then take a risk that it settles more or less than the secondary rate. And I have to wait until the next auction to find out. My thought is I would rather lock in a known rate than an unknown rate. So, I am thinking of purchasing today. Any flaws in my logic?

I know many of you would suggest not locking in 5 years, since you believe interest rates will continue to rise, but, they may fall as well. So, my question is not about locking in 5 years but rather about buying Treasuries at Secondary vs Auction. I have never purchased a Treasury before and want to make sure I am not missing something.

Excellent post from the always-worth-following TIPSwatch site that both answers your question about how to buy Treasuries (both at Treasury Direct and at a brokerage) and shows why a rolling TBill ladder may be not just the best place to park cash but (along with TIPS) the best fixed income choice altogether:

https://tipswatch.com/2022/09/21/short-term-treasurys-even-more-attractive-now/

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I have a mish mosh of T bills purchased over the past few months maturing in varying amounts scattered over the next 6 or 7 weeks. I want to start a ladder but just haven't gotten a feel for when to start this or how to allocate the money because I have never done this.

Today I sat down and listed all the T bills I have, when they mature and what's in my rollover IRA's Settlement Fund. I decided to let all the T bills mature and just go back into my Settlement Fund and forget about reinvesting them. I will start to buy 14 3 month T bills every other week starting now out to about 12/18 or 12/22 at which point the 1st purchase will mature. I can then use that to buy 14 more 3 month T bills 2 weeks later.

It seems pretty easy but for some reason I just could not wrap my head around how to do this due to the T bills that have not yet matured and how they figured into laddering. Plenty of folks endorse laddering and me trying to guess whether to buy at auction or in the secondary market and when to buy has kind of become a PITA. This will simplify things and take the guess work out of it and make it a mechanical action every other week.

3 month t-bills won't give you the higher rates we are now seeing.

I use an 18 month ladder with six steps (thanks to PB4 for enlightening me). Last week I built a ladder of 3, 6, 9, 12, 15 and 18 month CDs and Treasuries. Now every three months one comes due. At that point each new renewal will be 18 months. That keeps the 3 month separation between maturities going. If I think rates are going to flatten or go down I might extend the renewals out to 2 years or more.

I don't get the highest rates all the time, but I don't get locked into long term low rate CDs/Treas if inflation surges to double digits. And unless the yield curve gets very funny, I will earn more than simply turning over 3 mo treasuries.

Last edited:

Graybeard

Full time employment: Posting here.

- Joined

- Aug 7, 2018

- Messages

- 599

True, going beyond 3 months you will get higher rates but you are buying a new rung on the ladder every 3 months. By buying a 3 month T bill every other week you can capture changing rates sooner. Now they could change to the downside but over the next 3-6 months it seems unlikely that the Fed will be pivoting and if they keep raising the over night rate that can raise T bills. I'm always looking at how to do something better so I'm not sure if your way is better or different and we'd only know in hindsight.3 month t-bills won't give you the higher rates we are now seeing.

I use an 18 month ladder with six steps (thanks to PB4 for enlightening me). Last week I built a ladder of 3, 6, 9, 12, 15 and 18 month CDs and Treasuries. Now every three months one comes due. At that point each new renewal will be 18 months. That keeps the 3 month separation between maturities going. If I think rates are going to flatten or go down I might extend the renewals out to 2 years or more.

I don't get the highest rates all the time, but I don't get locked into long term low rate CDs/Treas if inflation surges to double digits. And unless the yield curve gets very funny, I will earn more than simply turning over 3 mo treasuries.

I am asking, is purchasing a 3 month T bill every other week not as good as just creating an 18 month ladder today?

disneysteve

Thinks s/he gets paid by the post

- Joined

- Feb 10, 2021

- Messages

- 2,430

Right now, a 3-month is paying about 3.3%. An 18-month is paying 4.2%. Also, as you wait to buy, you are leaving your cash sitting in the settlement fund paying 2.1%. That means you are sacrificing sure gains while betting that rates will increase fast enough and high enough to offset that.I am asking, is purchasing a 3 month T bill every other week not as good as just creating an 18 month ladder today?

Personally, I'd go with making the ladder now and rolling over a rung every 3 months. You could also put more rungs on the ladder and roll over a chunk every month if you'd like. But I wouldn't just sit on the cash and wait to buy later.

copyright1997reloaded

Thinks s/he gets paid by the post

True, going beyond 3 months you will get higher rates but you are buying a new rung on the ladder every 3 months. By buying a 3 month T bill every other week you can capture changing rates sooner. Now they could change to the downside but over the next 3-6 months it seems unlikely that the Fed will be pivoting and if they keep raising the over night rate that can raise T bills. I'm always looking at how to do something better so I'm not sure if your way is better or different and we'd only know in hindsight.

I am asking, is purchasing a 3 month T bill every other week not as good as just creating an 18 month ladder today?

disneysteve points out the issue with keeping cash sitting (perhaps earning nothing).

Most of my cash sitting is at least in some place like Ally earning 2.1% so it is not super terrible compared to the short end of a 18 month T-Bill curve. For example, this past weeks 4-week auction had a YTM of 2.703%.

My approach (for better or worse) has been to move money in from places like Ally piecemeal, and to purchase towards the peak of the yield curve, adjusted by the fact that I may move in 2023 and want to have cash available for a house purchase. (I already have a house but who knows what the housing market will be in 2023.)

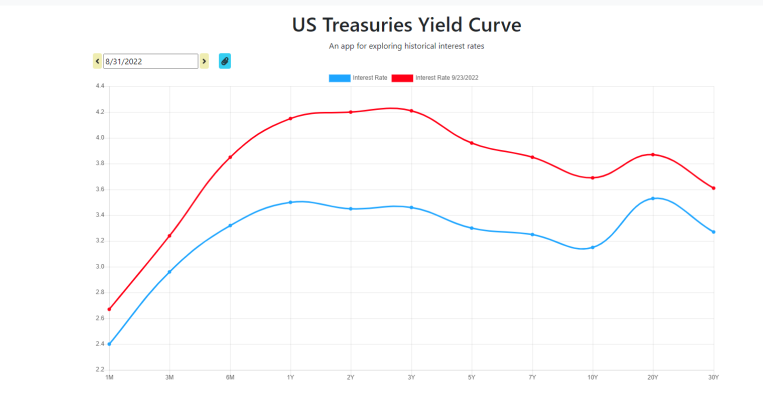

Attached is the treasury yield curve showing Friday's rates along with where things were at the end of August. With rates moving up so quickly, it has paid to keep short (e.g. 6 months or a year) vs. just laddering out all at once?

In terms of a traditional bond ladder, 18 months is extremely short. If one thinks that the rates will continue to go up quickly, stay even shorter. If one thinks that things will flatten out, rise slowly, or even dip- then increasing the duration a bit might be the play.

In another thread I mentioned I might be moving $ from a 401k stable value to a rollover IRA. If I do that, I might be tempted to go beyond 6-month T-bills on some of it, i.e. do what you are suggesting. However, if we get a couple point run up in rates by early 2023, we will be grumbling about only getting 4% when treasuries are over 6.

Decisions, Decisions.

Attachments

Graybeard

Full time employment: Posting here.

- Joined

- Aug 7, 2018

- Messages

- 599

Interesting comments.

All this is about my RO IRA where I have the most of my portfolio. I just checked and the Vanguard Settlement Fund's 7 day SEC yield is 2.49% so a little below a 4 week T bill so that isn't bad for being liquid, if rates rise and you sell the 4 week bill you'll lose money right now assuming rates will continue to rise. Anyone have a crystal ball that works?

My problem or issue or concern is RMDs and having enough "cash" to buy equities should the market go down to say 3400. Prior to this year, tying up money in my RO IRA wouldn't be a problem but now I am in a place where I want cash just in case (could be an RMD to pay for a total strip down for a new roof) or the ability to move some money into equities at a really low level and to get a decent return on the "cash" I am tying up in T bills.

All these concerns are brand new and I don't have a feel for this yet, life was less complicated before RMDs. This is why the 13 week bill purchases every other week seemed less "risky", I'm defining risky as having money tied up for what I think is long time frames. I guess there is no wrong answer just how I want to do this but selecting the "best" way to do it. It is not good to be a perfectionist with analysis paralysis.

All this is about my RO IRA where I have the most of my portfolio. I just checked and the Vanguard Settlement Fund's 7 day SEC yield is 2.49% so a little below a 4 week T bill so that isn't bad for being liquid, if rates rise and you sell the 4 week bill you'll lose money right now assuming rates will continue to rise. Anyone have a crystal ball that works?

My problem or issue or concern is RMDs and having enough "cash" to buy equities should the market go down to say 3400. Prior to this year, tying up money in my RO IRA wouldn't be a problem but now I am in a place where I want cash just in case (could be an RMD to pay for a total strip down for a new roof) or the ability to move some money into equities at a really low level and to get a decent return on the "cash" I am tying up in T bills.

All these concerns are brand new and I don't have a feel for this yet, life was less complicated before RMDs. This is why the 13 week bill purchases every other week seemed less "risky", I'm defining risky as having money tied up for what I think is long time frames. I guess there is no wrong answer just how I want to do this but selecting the "best" way to do it. It is not good to be a perfectionist with analysis paralysis.

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Sure, but there may be tax consequences in non-sheltered accounts.Can I convert all monetary assets? To T Notes, including IRA^s?

No worries. The government will just create whatever amount of money is needed. Defaults only happen to people who don't have the power to create the money that they owe.If T-Bills default then there won't be enough money in the FDIC to pay the insurance. T-Bills are safer than CDs. FDIC insurance is an illusion in the event of a mass default.

Right now, a 3-month is paying about 3.3%. An 18-month is paying 4.2%. Also, as you wait to buy, you are leaving your cash sitting in the settlement fund paying 2.1%. That means you are sacrificing sure gains while betting that rates will increase fast enough and high enough to offset that.

Personally, I'd go with making the ladder now and rolling over a rung every 3 months. You could also put more rungs on the ladder and roll over a chunk every month if you'd like. But I wouldn't just sit on the cash and wait to buy later.

My Vanguard settlement fund is at 2.49%. I don't know what the odds are of it going up fast enough to average 3.3% over the next three months, but I do think that the settlement fund is fairly likely to be above 3.3% in three months. I'm inclined to put half of my settlement account money into a relatively short term ladder (no more than 24 months with more going into a three month) right now and keep half of it in the settlement fund to invest in treasuries/CDs over the next few months.

This obviously is market timing, but it doesn't seem to be comparable to market timing for stocks because the Fed has pretty clearly indicated that it is going to be increasing interest rates during the rest of the year.

I admit, though, that I know very little about bonds, so this approach could be pretty dumb.

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

My Vanguard settlement fund is at 2.49%. I don't know what the odds are of it going up fast enough to average 3.3% over the next three months, but I do think that the settlement fund is fairly likely to be above 3.3% in three months. I'm inclined to put half of my settlement account money into a relatively short term ladder (no more than 24 months with more going into a three month) right now and keep half of it in the settlement fund to invest in treasuries/CDs over the next few months.

This obviously is market timing, but it doesn't seem to be comparable to market timing for stocks because the Fed has pretty clearly indicated that it is going to be increasing interest rates during the rest of the year.

I admit, though, that I know very little about bonds, so this approach could be pretty dumb.So, people should feel free to tell me how and why it is not a wise approach.

Whatever you do, it's a lot smarter than keeping your money in some of the big mega banks, or even some of the online banks. I just got a notice from one Big Name internet bank that I can now get a 3% one year CD. WOW? Nope. I just built a ladder that had a one year CD kissing close to 4%.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Whatever you do, it's a lot smarter than keeping your money in some of the big mega banks, or even some of the online banks. I just got a notice from one Big Name internet bank that I can now get a 3% one year CD. WOW? Nope. I just built a ladder that had a one year CD kissing close to 4%.

One year is at 4.05% now. Likely to rise too.

calmloki

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

So what rate are we guessing for the auction tomorrow for the six month bond? I'm planning to wait for the October 3 auction to buy again. The 6 month T-bill was something like 3.8% annualized for the September 19th auction - reckon it will hit 4.1% tomorrow?

That is true up to a point. If the FDIC runs out of money (like the FSLIC did in the late 1980s) the government can step in and make depositors whole. In the FSLIC instance it took a long time for that to happen. In the meantime your money is earning nothing and is completely illiquid.No worries. The government will just create whatever amount of money is needed. Defaults only happen to people who don't have the power to create the money that they owe.

There is ZERO doubt that Treasury bills are safer than CDs. Anyone who claims they are equally safe just doesn't understand the underlying characteristics of the products.

6 month yields were approaching 3.9% on Friday and are higher this morning. The 2 year yields are up to 4.3% this morning. There is also a 2-year note auction later today. It will be interesting to see if that yield comes in in that area. We'll see.So what rate are we guessing for the auction tomorrow for the six month bond? I'm planning to wait for the October 3 auction to buy again. The 6 month T-bill was something like 3.8% annualized for the September 19th auction - reckon it will hit 4.1% tomorrow?

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

3.9+%?So what rate are we guessing for the auction tomorrow for the six month bond? I'm planning to wait for the October 3 auction to buy again. The 6 month T-bill was something like 3.8% annualized for the September 19th auction - reckon it will hit 4.1% tomorrow?

It’s showing 3.926% early market.

There is ZERO doubt that Treasury bills are safer than CDs. Anyone who claims they are equally safe just doesn't understand the underlying characteristics of the products.

Agree, and the lesson from 2008...big banks don't fail? Really?

JoeWras

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 18, 2012

- Messages

- 11,738

TD publishes 3.981% (Investment rate - very close to approximate APR) for 26 week T-Bill. Probably headed to 4+ next week.

https://www.treasurydirect.gov/instit/annceresult/annceresult.htm

https://www.treasurydirect.gov/instit/annceresult/annceresult.htm

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Well, I guess I just don't understand then. In terms of getting one's money back IMO they are the same. Admittedly possible bureaucratic delay favors the govvies but I don't think that jeopardizes "safe."... There is ZERO doubt that Treasury bills are safer than CDs. Anyone who claims they are equally safe just doesn't understand the underlying characteristics of the products.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I read 3.913% for t-bills 6 month. (1140AM CNBC).

TD Ameritrade yield is 3.7 for the T-bills Secondary Market 6 month.

FIDO yield is 3.79 for T-bills sec mkt.

It was 3.981% at auction on the Treasury Direct Auction Results page. Investment rate which is the best APR comparison.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Well, I guess I just don't understand then. In terms of getting one's money back IMO they are the same. Admittedly possible bureaucratic delay favors the govvies but I don't think that jeopardizes "safe."

I agree... as long as you stay within the FDIC limits then you will get your money back... and probably your contractual rate of interest too... but you might have to wait a bit for it. I agree that UST have a slight edge in that regard but it is really a nit in terms of differences in risk.

copyright1997reloaded

Thinks s/he gets paid by the post

Well, I guess I just don't understand then. In terms of getting one's money back IMO they are the same. Admittedly possible bureaucratic delay favors the govvies but I don't think that jeopardizes "safe."

The FDIC's is backed by the "Full faith and credit" of the US Treasury but the devil is in the details.

Here is one, namely a limit on the FDIC's ability to borrow from the US Treasury:

(a) BORROWING FROM TREASURY.--

(1) IN GENERAL.--The Corporation is authorized to borrow from the Treasury, and the Secretary of the Treasury is authorized and directed to loan to the Corporation on such terms as may be fixed by the Corporation and the Secretary, such funds as in the judgment of the Board of Directors of the Corporation are from time to time required for insurance purposes, not exceeding in the aggregate $100,000,000,000 outstanding at any one time, subject to the approval of the Secretary of the Treasury:

Yes, 100 billion is a lot. Yes, I sleep at night knowing that FDIC deposits are insured and have US Treasury backing.

But there are differences between an FDIC insured bank account and a direct Treasury obligation.

I am posting this not to scare anyone from FDIC-insured deposits, only for education (to anyone who cares) about how the FDIC government backing works.

Reference: https://www.fdic.gov/regulations/laws/rules/1000-1600.html#fdic1000sec.14a

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

All that is very nice, but irrelevant. The politicians are not going to let FDIC stiff people. Period. Rules and procedures will be rewritten on the fly as necessary. That is the way the government backing will work.... I am posting this not to scare anyone from FDIC-insured deposits, only for education (to anyone who cares) about how the FDIC government backing works. ...

copyright1997reloaded

Thinks s/he gets paid by the post

All that is very nice, but irrelevant. The politicians are not going to let FDIC stiff people. Period. Rules and procedures will be rewritten on the fly as necessary. That is the way the government backing will work.

Whatever. You keep insisting they are the same. They are not.

Did I say it was worth worrying about? No. But to insist "The politicians are not going to let the FDIC stiff people" is an assumption.

- Status

- Not open for further replies.

Similar threads

- Replies

- 239

- Views

- 27K

- Replies

- 459

- Views

- 52K

- Replies

- 53

- Views

- 6K