If I'm beating a dead horse just let me know, I certainly do not want to offend anyone.

The underlying economic problem is profit-price inflation. It’s caused by corporations raising their prices above their increasing costs.

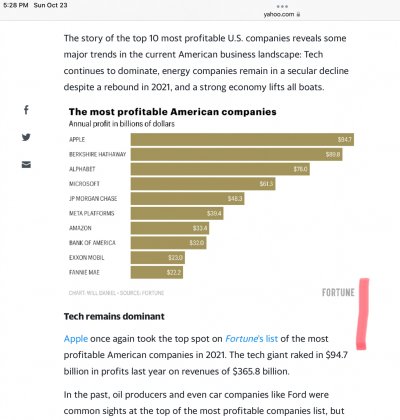

Corporations are using those increasing costs – of materials, components and labor – as excuses to increase their prices even higher, resulting in bigger profits. This is why corporate profits are close to levels not seen in over half a century.

Corporations have the power to raise prices without losing customers because they face so little competition. Since the 1980s, two-thirds of all American industries have become more concentrated.

Why are grocery prices through the roof? Because just four companies control 85% of meat and poultry processing. Just one corporation sets the price for most of the nation’s seed corn. And two giant firms dominate consumer staples.

All are raising prices and increasing profits because they can.

Big pharma, comprising five giants, is causing drug prices to soar.

The airline industry has gone from 12 carriers in 1980 to just four today, all rapidly raising ticket prices.

Wall Street has consolidated into five giant banks, raking in record profits on the spreads between the interest they pay on deposits and what they charge on loans.

Broadband is dominated by three giant cable companies, all raising their prices.

Automobile dealers are enjoying record profits as they raise the retail prices of automobiles.

Gas prices have started to drop but big oil still has the power to raise prices at the pump far higher than the costs of crude.

https://www.theguardian.com/commentisfree/2022/sep/25/inflation-price-controls-robert-reich