I understand the seller - a little bit.

In our small community, we have a nicer home that we have worked super hard on improving over a few years. So, now it will be on the upper end. Very few homes are really updated, and 99% (?) are very traditional homes with closed formal spaces. Our home is now contemporary, open floor plan, etc.

There are a lot of curious people who try to visit every home that comes onto market. It is a barrage of visits, with some wanting to come back multiple times with friends, etc. making it very difficult on homeowners. Many of these are agents’ relatives. It’s a “thing to do” here.

Given our home uniqueness, it would be even more of a “draw” for “things to do”.

We have bought and sold maybe 10 homes, and we have always really staged and made home just right for views - but that’s not a real living condition. It’s a lot of work.

Many higher end home sellers, as a result, will only do “pocket listings”. Or better term - not actively on market, but agents know buyers would be willing to show to serious buyers. Home is not on MLS, and only shown to those few known to be serious buyers, many times with only their own brokerage. I think I counted 25 of 26 homes above a certain $ amount that were sold as a pocket listings (eventually listed and sold same day on MLS, with little to no info or pictures).

Technically, we bought this home when it was not on market. Agent knew family over bought and home was in pre-foreclosure process. Agent convinced bank to let sellers “swap” homes with a much less costly home and permitted a short sale, and then approved them on the smaller home. Banker understood that bank (and all parties) are better off this way then going through full foreclosure with its very lengthy process in this state.

I don’t like the pocket listing solution. I don’t like lots of people coming all the time that are not serious buyers.

We will have some realtors next week visit and decide on realtor and marketing plan.

I guess what I am saying - perhaps the seller is wary of unserious buyers and thought this was their solution.

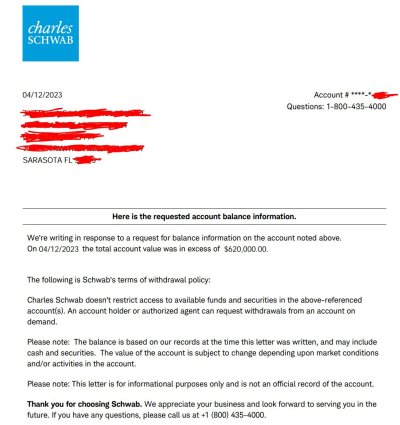

Don’t fret about the letter. Make it as high as possible - agents and sellers know that you are solid. It does not matter that they “know” you can afford more. There are lots of negotiation strategies that work with a known strong financial buyer