I was aware of Vanguard was predicting lower yields, but not Fidelity.

I did find an interesting Jan 2023 article on brokerage houses 10-year return forecasts by Morningstar at

https://www.morningstar.com/portfolios/experts-forecast-stock-bond-returns-2023-edition

For Fidelity they write:

Fidelity’s capital markets assumptions employ a 20-year horizon (2022-42) and therefore can’t be stacked up neatly against the 10-year returns from other firms in our survey. In addition, the firm states its capital markets assumptions in real (inflation-adjusted) terms; its base-case inflation rate over the 20-year horizon is 2.5%. Finally, the firm’s assumptions are based on data as of April 2022, so they don’t factor in the equity price declines and higher bond yields that came to pass later last year.

The firm is forecasting a 3.0% real return for U.S. equities over the next 20 years, less than half their 6.6% average return from 2001-21. Fidelity cites elevated equity valuations (again, as of April 2022) and reduced earnings potential as constraints on U.S. equity gains. On the fixed-income side, the firm was forecasting 1.9% 20-year real returns for the Bloomberg U.S. Aggregate Bond Index as of April 2022. Like all of the firms in our survey, Fidelity’s research accords a higher return assumption for non-U.S. equities for the next two decades: 3.3% real returns for developed non-U.S. equities and 5.1% for emerging-markets stocks.

So that would put Fidelity at 5.5% nominal returns for domestic equities (vs 9.1% historical average) and 4.4% nominal return for bonds over the next 20-years rather than the next 10-years, but still much lower than historical averages

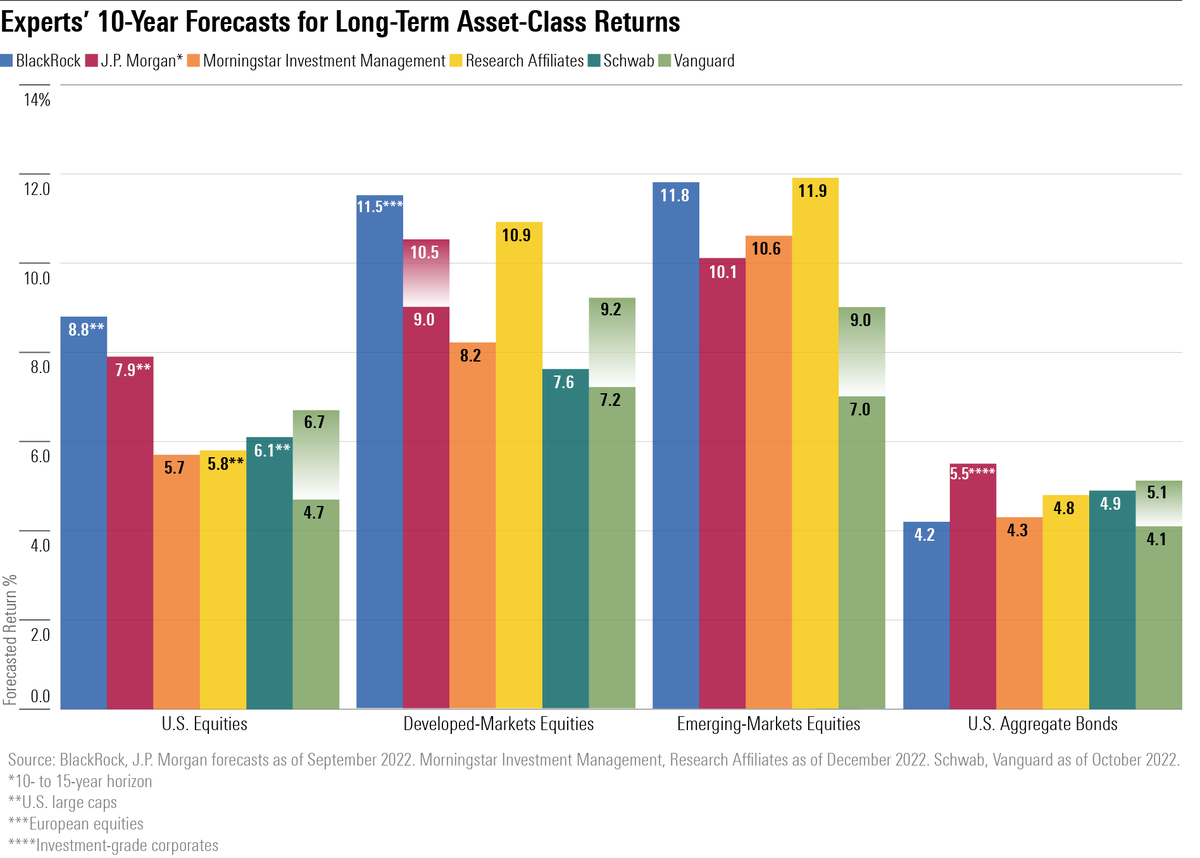

The Morningstar article includes an interesting chart of 10-year forecast asset class returns:

Morningstar, Schwab, Fidelity and Vanguard are all forecasting much lower than historical average nominal returns for equities for the next decade... 4.7-6.7% annual returns vs 10% historical average. For bonds, they are forecasting 4.1%-5.1%. I personally think they're probably right and the premium for investing in stocks isn't commensurate with the increased risk/volatility so while I'm still open to dabbling in equities when conditions warrant, I'm quite comfortable being out of equities right now.