Exit 2024

Recycles dryer sheets

- Joined

- Jun 23, 2015

- Messages

- 418

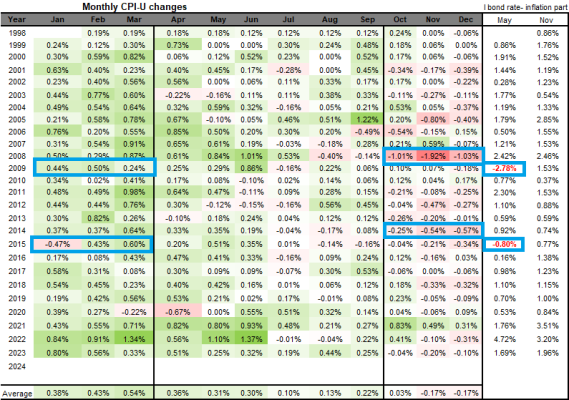

When I look at that chart, I note that the May 1 adjustment immediately following a fourth quarter with 3 months of negative CPI change is almost always substantially less than the preceding November 1 change.

Not sure that I understand the above, but table organized as line=year, so May 1 on line for 2023 uses last 3 months from the line above (2022) and first 3 months on the same line (2023).

If you you look at 2 instances where May 1 adjustment was negative - you can see that last 3 months from previous year was greatly exceeding current (2023 last 3 months) of -0.34% and were hard to offset. I still predict positive inflation rate for May 1 adjustment as -0.34% very close to long term average for those 3 months. I guess we will see ....

Attachments

Last edited: