walkinwood

Thinks s/he gets paid by the post

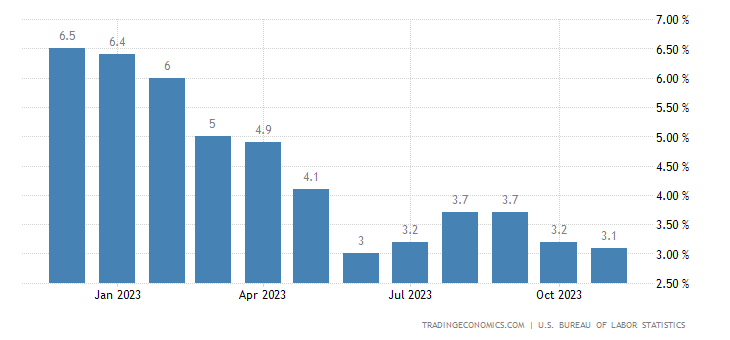

Like many, I bought I-bonds when inflation spiked up & the total interest rates on the bonds were mouth-watering.

To take the example of the i-bond I bought in December 2021 which has a fixed interest rate of 0% and currently has an inflation rate of 1.97%

I know I'll lose the last 3 months of interest if I were to sell them.

If I buy an I-Bond now, I get a fixed interest of 1.3% and a 1.97% inflation rate for the next 4 months.

Doesn't it make sense for me to redeem the 2021 i-bond and buy a Jan 2024 one?

By my calculations, I'll make up the loss of interest rate & fed tax in less than 6 months. (assuming the same 1.97% inflation rate)

The downside is that I could be increasing my i-bond holdings by another $10K instead of keeping the amount the same.

Any other downsides that I'm missing?

The other thought is to abandon the i-bonds and just add that money to my TIPs allocation. (I'd say, let's not go there now, but I know this forum )

)

To take the example of the i-bond I bought in December 2021 which has a fixed interest rate of 0% and currently has an inflation rate of 1.97%

I know I'll lose the last 3 months of interest if I were to sell them.

If I buy an I-Bond now, I get a fixed interest of 1.3% and a 1.97% inflation rate for the next 4 months.

Doesn't it make sense for me to redeem the 2021 i-bond and buy a Jan 2024 one?

By my calculations, I'll make up the loss of interest rate & fed tax in less than 6 months. (assuming the same 1.97% inflation rate)

The downside is that I could be increasing my i-bond holdings by another $10K instead of keeping the amount the same.

Any other downsides that I'm missing?

The other thought is to abandon the i-bonds and just add that money to my TIPs allocation. (I'd say, let's not go there now, but I know this forum