athena53

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 11, 2014

- Messages

- 7,385

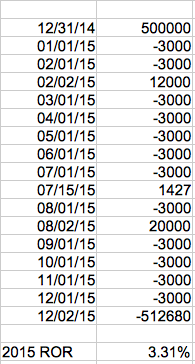

Morgan-Stanley account: up 0.3%. Fidelity: up 1.5%, overall 0.5%. Method: XIRR, then adjusted to YTD by raising it to (11/12) power. I've got a decent amount of bond funds, which dragged yields down, but the big culprit was a high-yield Chesapeake Energy bond I bought at par for about $25K, now worth $11,750. Ouch. Morgan-Stanley return would have been 0.6% without that drop. I'm still hanging onto it.