retire by 55

Confused about dryer sheets

We''re Californians, hoping to retire in CA or maybe Thailand since the cost of living is much lower there.

About us:

I'm 42, DH is 47. We would like to retire when I'm 55, so by year 2030. I've entered the numbers in the FIRE calculator and it found 0 cycles failed, but I'm not sure if I entered it correctly.

DH has a son who is 16 right now, so he will be totally independent by the time we retire. I don't have any kids. We did not come from money, in fact, our parents were very poor. We worked and put ourselves through college and paid for everything ourselves (college, wedding, cars, homes, etc).

Debts:

Student loan: will be paid off in 3 years

Rental property: will be paid off in 7 years (rent covers 100% of rental exp)

Primary residence: will be paid off by 2030 when we retire

Child Support: will be done in 2 years

Here is our asset:

Taxable acct: $566,000

Non-taxable acct: $723,000 (401k, Roth IRA, Rollover IRA, etc).

Total: $1,289,000

We will be adding about $80,000 to $85,000/year to that portfolio (this amount includes his 401k and my Simple IRA contribution from our workplace, and whatever money we have left after all the expenses are paid for).

Rental: Zillow estimate $720K

Primary Residence: Zillow estimate: $700k

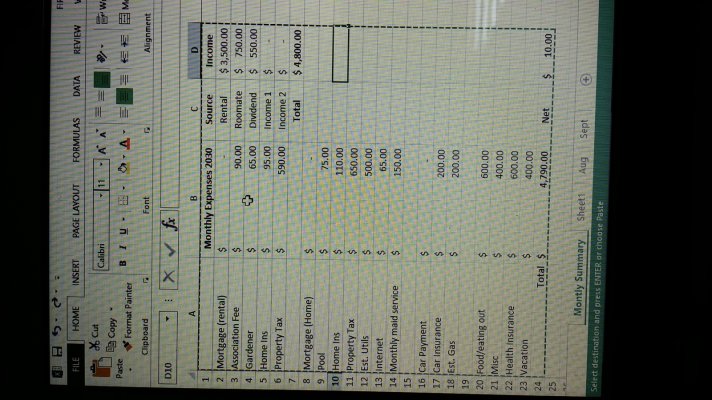

I've put all the income and expenses on the excel worksheet, and it shows we have about $4,800/month in expenses. That looks awfully low to me, especially in California. Am I missing something in my budget?

We will have to withdraw about $550 from dividend to cover the expenses after we retire. I've included the worksheet here (tried to attach my excel worksheet but couldn't, so I took a picture of it instead, sorry if it's not clear). I'm not sure how much medical insurance will cost in the future, so I put $600/month. How much should I budget for medical insurance? Maid service to clean the house once a month is nice, but that is optional. As for auto, we will need to buy a new car in 3-4 years because one of the car has over 150K miles, but it should be paid off by 2030.

Can you tell me what expense I'm missing so I can add that to my budget?

Will I still be able to retire by 55, even if I've made a mistake on the FIRE calculator or my budget?

Thank for your advice,

Retire by 55

About us:

I'm 42, DH is 47. We would like to retire when I'm 55, so by year 2030. I've entered the numbers in the FIRE calculator and it found 0 cycles failed, but I'm not sure if I entered it correctly.

DH has a son who is 16 right now, so he will be totally independent by the time we retire. I don't have any kids. We did not come from money, in fact, our parents were very poor. We worked and put ourselves through college and paid for everything ourselves (college, wedding, cars, homes, etc).

Debts:

Student loan: will be paid off in 3 years

Rental property: will be paid off in 7 years (rent covers 100% of rental exp)

Primary residence: will be paid off by 2030 when we retire

Child Support: will be done in 2 years

Here is our asset:

Taxable acct: $566,000

Non-taxable acct: $723,000 (401k, Roth IRA, Rollover IRA, etc).

Total: $1,289,000

We will be adding about $80,000 to $85,000/year to that portfolio (this amount includes his 401k and my Simple IRA contribution from our workplace, and whatever money we have left after all the expenses are paid for).

Rental: Zillow estimate $720K

Primary Residence: Zillow estimate: $700k

I've put all the income and expenses on the excel worksheet, and it shows we have about $4,800/month in expenses. That looks awfully low to me, especially in California. Am I missing something in my budget?

We will have to withdraw about $550 from dividend to cover the expenses after we retire. I've included the worksheet here (tried to attach my excel worksheet but couldn't, so I took a picture of it instead, sorry if it's not clear). I'm not sure how much medical insurance will cost in the future, so I put $600/month. How much should I budget for medical insurance? Maid service to clean the house once a month is nice, but that is optional. As for auto, we will need to buy a new car in 3-4 years because one of the car has over 150K miles, but it should be paid off by 2030.

Can you tell me what expense I'm missing so I can add that to my budget?

Will I still be able to retire by 55, even if I've made a mistake on the FIRE calculator or my budget?

Thank for your advice,

Retire by 55

Attachments

Last edited: