Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

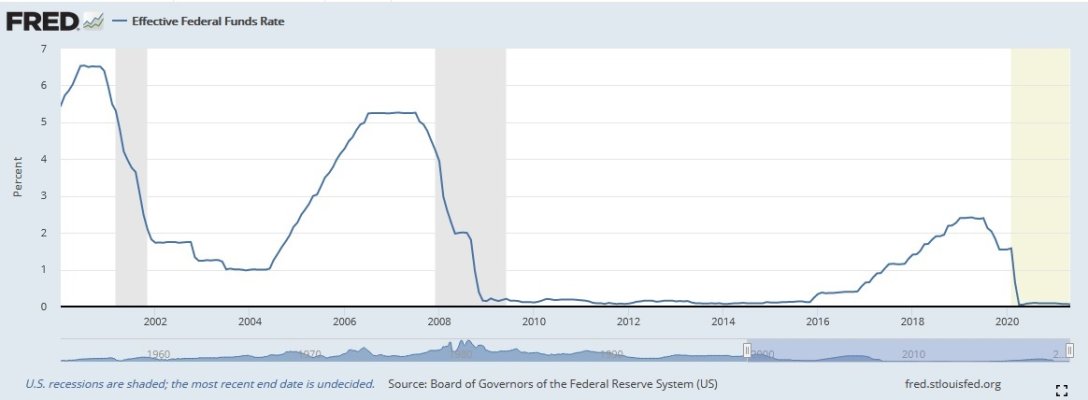

I will state that if one had waited then March 2020 would have provided an excellent opportunity to establish the 5% portfolio. As I pointed out at 12.60 DNP was about 20% too high and the fall under 10 would have been the point to once again set this up. The March portfolio would have had 350 more shares of DNP at 2K less in cost for the portfolio when it was established, so it would have been an ideal time. Sorry I missed pointing that out. So far I believe the portfolio will show it held up well through the market decline and in the coming years I expect the higher inflation will provide it's test for the portfolio. As of today, I see no reason that anything would have invalidated this as a strategy or a specific concern in the coming 10 years, I fully expect the portfolio to be able to handle what is thrown at it for the next 10 years, but that's just an internet opinion from me, warning see my sig.Interesting Question, the stock market has done nothing but go up since this portfolio was started and interest rates down, so 5% withdraswal I would not suggest with this portfolio today at this time. As DNP is probably about 20% too high I would say 4% is the best this portfolio would do, if I was starting now I would wait a year or two and in that time I expect DNP will come back to the range where 5% would be effective again.

Although if established I would hold on to it as the portfolio shows no real signs of failing and will do ok in a market decline or an inflationary surge.

RM

Last edited: