supernova72

Recycles dryer sheets

Actually, if the fund choices and costs are good like you say and you have access to a SV fund that pays 2.1% you may want to just stay with the 401k and forget a rollover.... you can't get a SV fund in an IRA and 2.1% with no interest rate risk is pretty good in this low interest rate environment (I wish I had a SV fund like that available to me).

OP here..

Our SV gets adjusted each quarter but has been ~2% for a few yrs now. I moved some stuff out of the Bond fund a few months back post prez election.

They just re-vamped our Retirement Savings website and the changes make it look pretty fancy. I'm also breaking the "60/40" rule I realize with a bit more in equities but my strategy is my Pension is basically a fixed annuity so I'm rolling the dice a bit by being at 68% ish equities right now. They also offer a full lineup of Lifecycle funds and some that I'm not in like Boeing Stock and Science and Tech. Mostly managed by State Street and Blackrock. None of them have stock symbols---which I thought was weird. Turns out these funds where designed for The Boeing Company exclusively.

For the S&P 500 Index fund the operating expenses are .05%

The description on most funds says this:

Ticker Symbol:

The investment options within the Voluntary Investment Plan (401K) do not have ticker symbols because they are not mutual funds. Boeing offers Voluntary Investment Plan participants a series of custom funds, whereby the company has utilized the Plan’s scale of size to negotiate reduced fees versus what would be experienced in a mutual fund.

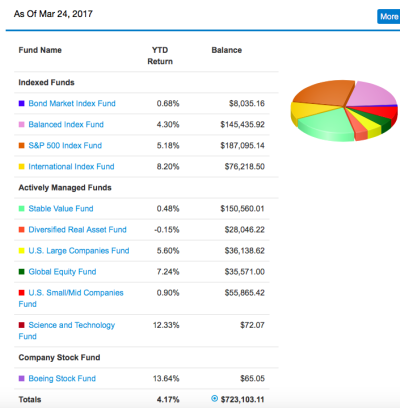

I now realize I should have been a bit more transparent about my fund choices and where I have my current investments so I'll attach it below. This is through March 24th, 2017. I have one clunker in the Diversified Assets Fund but the rest have done pretty well. So here you go. Cheers.