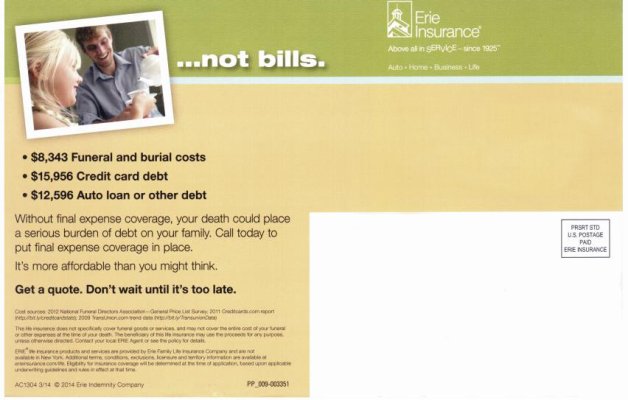

I received a postcard-type advertisement for life insurance today that initially frosted me. Now, normally I don't even look at those things but this one for some reason caught my eye and was particularly insulting. As if I would leave DW saddled with a bunch of debt! It lists as "typical" debts of $8,343 in funeral expenses, $15,956 in credit card debt, and $12,596 in auto and other loans.

That got me to wondering - is that really the norm? Do so many people carry that much debt that they still have it when they get The Big Ache? So I started searching for a bit and came away a tad better informed and somewhat sadder. While the ones on the postcard seem typical they are a bit on the high side. and probably not the norm for people of retirement age This article is typical: A Lifetime of Debt: The Financial Journey of the Average American

According to this article the average American will spend $600,000 on interest payments over their lifetime. How sad.

It also reinforces the point about what a bunch of outliers this group is. Oh well, I guess I'll just go on my ignorant way and spend that $600k on things other than enriching bankers.

Just a sort of rant, but I kinda would like to think that people were smarter than that.

That got me to wondering - is that really the norm? Do so many people carry that much debt that they still have it when they get The Big Ache? So I started searching for a bit and came away a tad better informed and somewhat sadder. While the ones on the postcard seem typical they are a bit on the high side. and probably not the norm for people of retirement age This article is typical: A Lifetime of Debt: The Financial Journey of the Average American

According to this article the average American will spend $600,000 on interest payments over their lifetime. How sad.

It also reinforces the point about what a bunch of outliers this group is. Oh well, I guess I'll just go on my ignorant way and spend that $600k on things other than enriching bankers.

Just a sort of rant, but I kinda would like to think that people were smarter than that.

If he paid that much in interest, anybody could do it.

If he paid that much in interest, anybody could do it.