photoguy

Thinks s/he gets paid by the post

- Joined

- Jun 15, 2010

- Messages

- 2,301

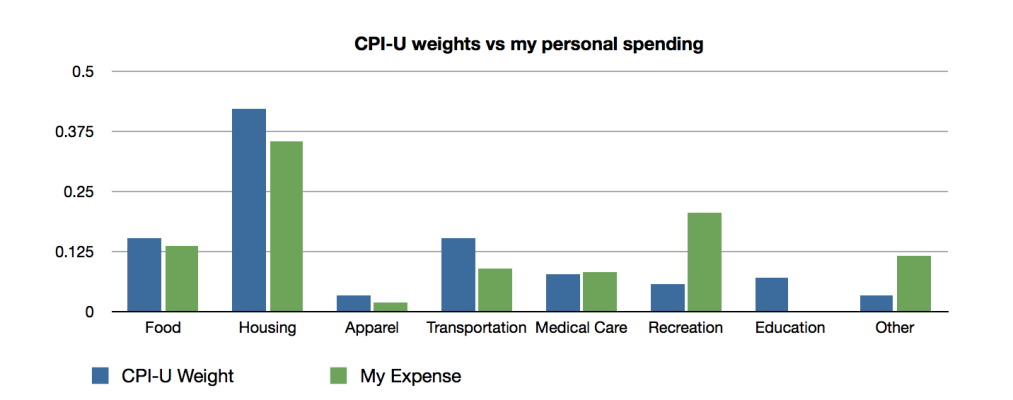

Personal Inflation Rates vs CPI-U

Since I was working on my expense spreadsheet anyway (to tally for end of year), I made a quick chart comparing my expenses to the top category CPI-U weights.

Surprisingly (to me), they were not that different. Our spending underweights almost all categories except for recreation. I guess the big concern of mine would be medical care which is still low for us now but might be a much bigger chunk as we get older. This might result in CPI-U understating our personal inflation rate. However this might be offset by the fact that we have no educational expenses (another area with higher than normal inflation rates).

Since I was working on my expense spreadsheet anyway (to tally for end of year), I made a quick chart comparing my expenses to the top category CPI-U weights.

Surprisingly (to me), they were not that different. Our spending underweights almost all categories except for recreation. I guess the big concern of mine would be medical care which is still low for us now but might be a much bigger chunk as we get older. This might result in CPI-U understating our personal inflation rate. However this might be offset by the fact that we have no educational expenses (another area with higher than normal inflation rates).