Alex The Great

Recycles dryer sheets

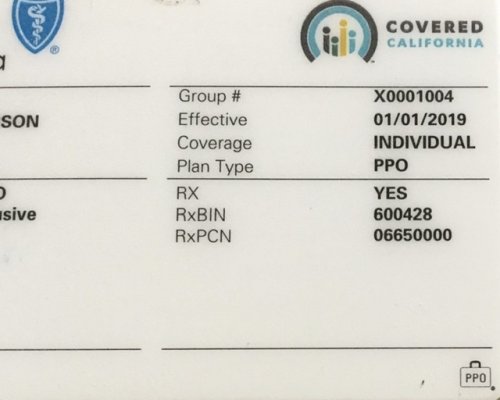

I believe it is not a secret that many doctors does not like plans offered on exchange. Are there any individual health insurance plans which has a network similar to employer provided plans? For example, when buying directly through BCBS without subsidy?

Other question I have is about Medicaid expansion. Apparently very low income is required to qualify for it. But would it have any difference in the network size, compared to ACA?

Your feedback would be appreciated!

Other question I have is about Medicaid expansion. Apparently very low income is required to qualify for it. But would it have any difference in the network size, compared to ACA?

Your feedback would be appreciated!