So, here is my situation. My wife and I plan to retire next year. I will retire a few months earlier than she will. My wife is currently on my healthcare policy.

Both of our employers offer retiree healthcare plans.

I have determined that we will not be able to qualify for any ACA tax credit subsidies based on our MAGI.

Here are my questions:

1. Would my wife qualify for ACA if she is still working and would be eligible for health coverage through her job? Once again, she will be still working once I retire for a few months.

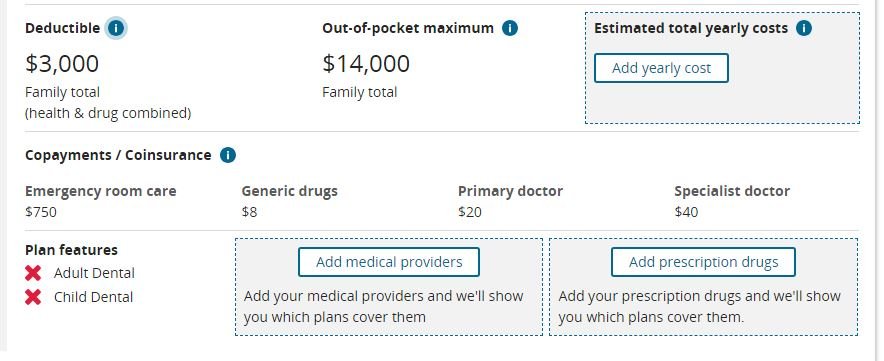

2. Would it be cost effective to go with an ACA plan or my company retiree healthcare plan?

Both of our employers offer retiree healthcare plans.

I have determined that we will not be able to qualify for any ACA tax credit subsidies based on our MAGI.

Here are my questions:

1. Would my wife qualify for ACA if she is still working and would be eligible for health coverage through her job? Once again, she will be still working once I retire for a few months.

2. Would it be cost effective to go with an ACA plan or my company retiree healthcare plan?

Last edited: