Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

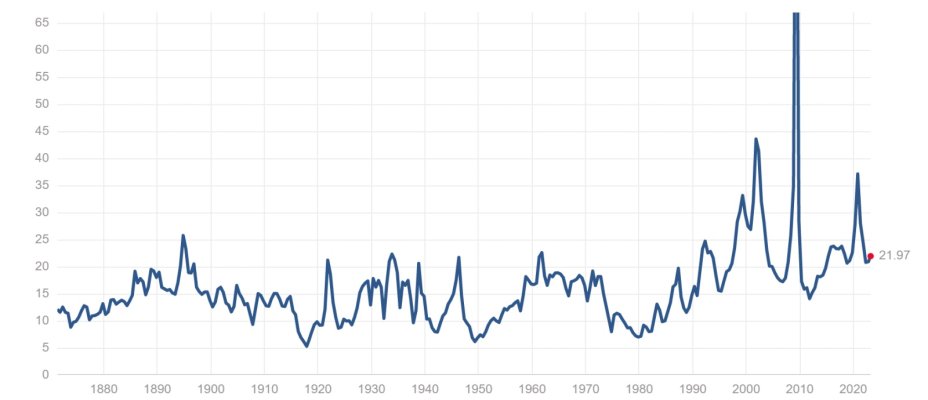

PE ratios arent predictive...think about it...beginning of 2009 the PE was like 40....year later the market was up like 70%....

Sure. But not like we have had some massive earnings decline that drove PE's up from historically normal level.