Sandy & Shirley

Recycles dryer sheets

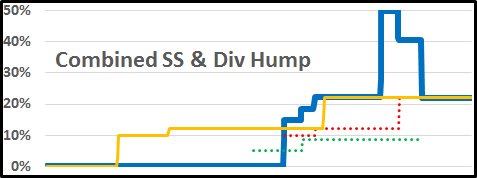

We are in the process of planning our retirement strategy and discovered that age 62 is a critical age for doing Roth conversions.

The cost of your Medicare premiums is determined by your Modified Adjusted Gross Income (MAGI), which includes the size of your conversions, on your tax return from 2 years prior to paying your Medicare premiums. Your first Medicare premiums at age 65 will be determined by your income the year you turned 63. Your age 66 premium depends on you age 64 MAGI, etc.

Your basic Medicare cost is $1,608 per year. If your MAGI at age 63 is over $85,000 that cost will increase by $642 to $2,250, over $107,000 and that extra cost will be $1,606.80 almost doubling your Medicare cost at age 65 to $3,214.80, and this continues as your income from 2 years prior continues to increase.

If you are planning to do any major Roth Conversions to avoid or minimize your Required Minimum Distribution at age 70, make sure you factor in the additional cost of your Medicare when you do those conversions after the age of 62.

Your conversions will also effect the amount of your Social Security income that is taxable, so doing the conversions BEFORE you start your benefits is also a factor.

The cost of your Medicare premiums is determined by your Modified Adjusted Gross Income (MAGI), which includes the size of your conversions, on your tax return from 2 years prior to paying your Medicare premiums. Your first Medicare premiums at age 65 will be determined by your income the year you turned 63. Your age 66 premium depends on you age 64 MAGI, etc.

Your basic Medicare cost is $1,608 per year. If your MAGI at age 63 is over $85,000 that cost will increase by $642 to $2,250, over $107,000 and that extra cost will be $1,606.80 almost doubling your Medicare cost at age 65 to $3,214.80, and this continues as your income from 2 years prior continues to increase.

If you are planning to do any major Roth Conversions to avoid or minimize your Required Minimum Distribution at age 70, make sure you factor in the additional cost of your Medicare when you do those conversions after the age of 62.

Your conversions will also effect the amount of your Social Security income that is taxable, so doing the conversions BEFORE you start your benefits is also a factor.