street

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 30, 2016

- Messages

- 9,565

333three

Congratulations on your accomplishments! Very nice and a portfolio like yours takes work and doesn't happen by accident.

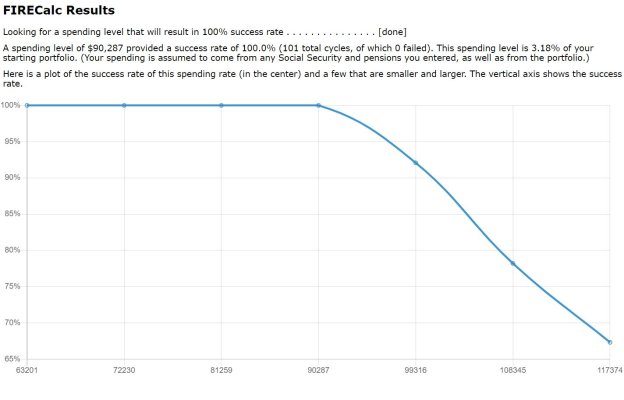

I'm far from an expert on finances but but running your numbers with what you say are your expenses quoted, you should be good for 45 years in ER. Of course you have SS coming at some point also.

Health care is something you will want to explore (ACA).

I beleive you will be good to go and because you are responsible spenders and savers.

Congratulations on your accomplishments! Very nice and a portfolio like yours takes work and doesn't happen by accident.

I'm far from an expert on finances but but running your numbers with what you say are your expenses quoted, you should be good for 45 years in ER. Of course you have SS coming at some point also.

Health care is something you will want to explore (ACA).

I beleive you will be good to go and because you are responsible spenders and savers.