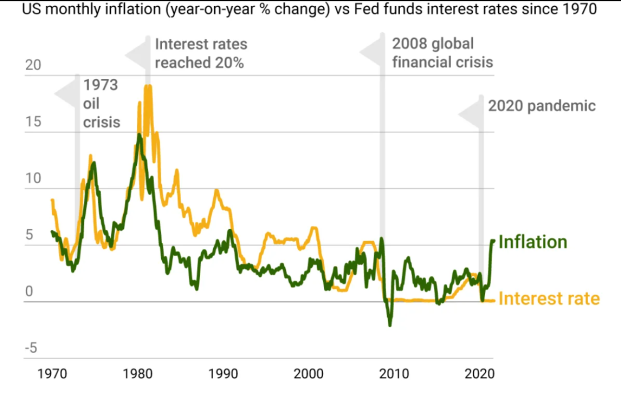

Here is another prediction on results of last rate increase (and the rate is only 1.5%-1.75% vs inflation of 8.6%)

https://www.yahoo.com/finance/news/stock-markets-nightmare-scenario-50-123000342.html

https://www.yahoo.com/finance/news/stock-markets-nightmare-scenario-50-123000342.html