With hopes of relocation and reemployment just around the corner, and just fresh out of the company's retirement seminar, here are some numbers from their sponsored annuities they offer.

Funded Amount : $350000

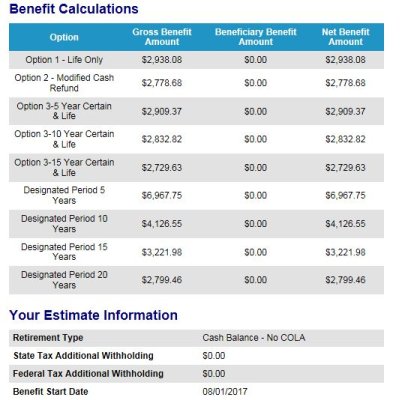

No Cola

No Spousal Benefit

Annuity Rate 7.75%

Option 1-Life Only $2938.08 per month

20 year only $2799.46 per month

The funded amount is currently in 401K Guaranteed 5% Cash Balance Account.

The funded amount is 21% of our retirement account balance.

I am 62.5 and my DW is 55.99999, Happy Bday Honey.

If this thread gets read, I will post all options available to me,

Thanks

Funded Amount : $350000

No Cola

No Spousal Benefit

Annuity Rate 7.75%

Option 1-Life Only $2938.08 per month

20 year only $2799.46 per month

The funded amount is currently in 401K Guaranteed 5% Cash Balance Account.

The funded amount is 21% of our retirement account balance.

I am 62.5 and my DW is 55.99999, Happy Bday Honey.

If this thread gets read, I will post all options available to me,

Thanks