Been with Vanguard in various amounts and accounts all my life.

Had an account with Capital One for years that was in my name only. I wanted to add my wife as joint owner for convenience if I die before her. But Capital One was making that difficult so I opened a new joint brokerage acct. at Vanguard. Transferred the money over in 2 or 3 transactions the last being on August 4th. Set up the checking account for transfers and did the verification where they make two small deposits and you verify the amounts.

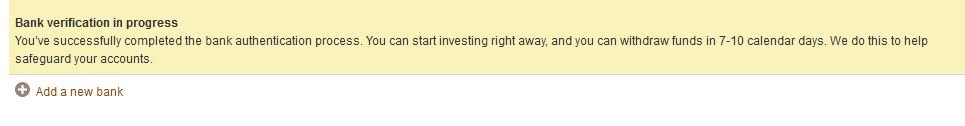

Now it's Sept. 9th. Wife wants $$$ in her checking account. Go to Vanguard to make a transfer out and I get a message that they won't due it because the funds were recently transferred in. What? Five weeks?

Can't find a phone number anywhere on their site. Finally found a way to send a message. Looks like this account is going to be short lived.

Had an account with Capital One for years that was in my name only. I wanted to add my wife as joint owner for convenience if I die before her. But Capital One was making that difficult so I opened a new joint brokerage acct. at Vanguard. Transferred the money over in 2 or 3 transactions the last being on August 4th. Set up the checking account for transfers and did the verification where they make two small deposits and you verify the amounts.

Now it's Sept. 9th. Wife wants $$$ in her checking account. Go to Vanguard to make a transfer out and I get a message that they won't due it because the funds were recently transferred in. What? Five weeks?

Can't find a phone number anywhere on their site. Finally found a way to send a message. Looks like this account is going to be short lived.