Ronstar

Moderator Emeritus

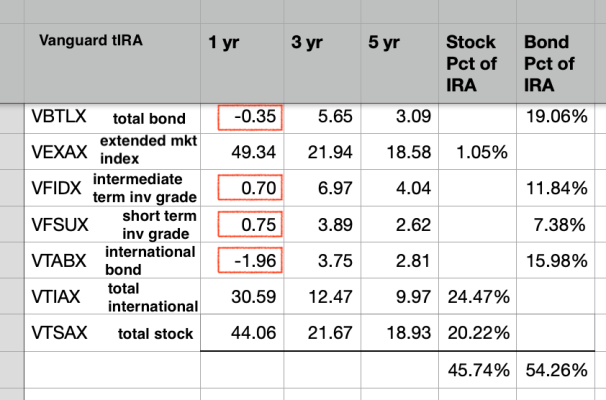

When I retired, I rolled about 60% of my 401k into a Vanguard tIRA shown in the attached image. The fund mix is as suggested by a Vanguard rep.

I have another IRA with an FA. My VG IRA's return has beat the FA's return year after year given similar asset ratios at the time.

However, my FA IRA is currently 10.2% ytd at 56/37/7 AA. My VG IRA is 5.3% at 46/54 AA.

The AA hasn't always been this bond heavy in the VG tIRA - I do Roth conversions from VTSAX total stock in the tIRA.

The image highlights how low VG bond fund returns have been in the past year compared to their 3 and 5 year returns.

I'd like to increase the returns from the bond segment yet maintain a similar level of safety that my current mix provides.

I originally wanted to have Wellesley in the mix, but VG's advisor suggested this mix instead - said that this is less maintenance $ IIRC.

Wellesley is a 38/60/2 AA. And is at 14.92% 1 yr return compared to 10.56 and 7.99 for 3 and 5 yrs. My thoughts are to tweak the fund mix, eliminating all current bond funds, bringing in Wellesley, keeping the stock funds, and rework the AA of the IRA to 50/50.

I don't foresee withdrawing from this account for at least 6 years at age 72. Any future Roth conversions can come from the stocks.

Thoughts?

I have another IRA with an FA. My VG IRA's return has beat the FA's return year after year given similar asset ratios at the time.

However, my FA IRA is currently 10.2% ytd at 56/37/7 AA. My VG IRA is 5.3% at 46/54 AA.

The AA hasn't always been this bond heavy in the VG tIRA - I do Roth conversions from VTSAX total stock in the tIRA.

The image highlights how low VG bond fund returns have been in the past year compared to their 3 and 5 year returns.

I'd like to increase the returns from the bond segment yet maintain a similar level of safety that my current mix provides.

I originally wanted to have Wellesley in the mix, but VG's advisor suggested this mix instead - said that this is less maintenance $ IIRC.

Wellesley is a 38/60/2 AA. And is at 14.92% 1 yr return compared to 10.56 and 7.99 for 3 and 5 yrs. My thoughts are to tweak the fund mix, eliminating all current bond funds, bringing in Wellesley, keeping the stock funds, and rework the AA of the IRA to 50/50.

I don't foresee withdrawing from this account for at least 6 years at age 72. Any future Roth conversions can come from the stocks.

Thoughts?