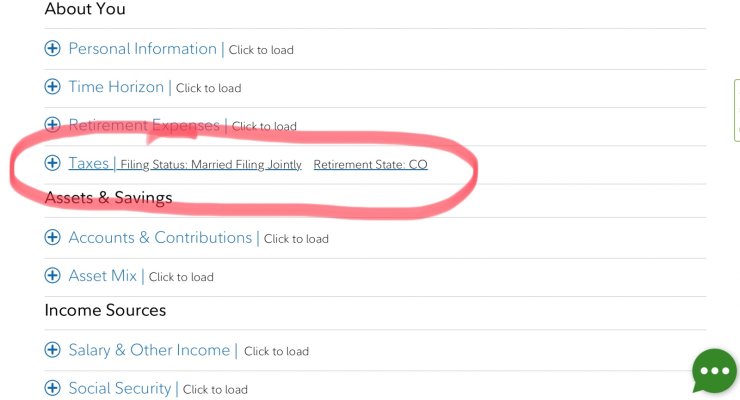

Taxes are a major issue during your retirement years. My last job before retirement was working for a mutual fund, and I had to sign a paper stating that I knew it was against the law for me to talk to any of our customers about their taxes!

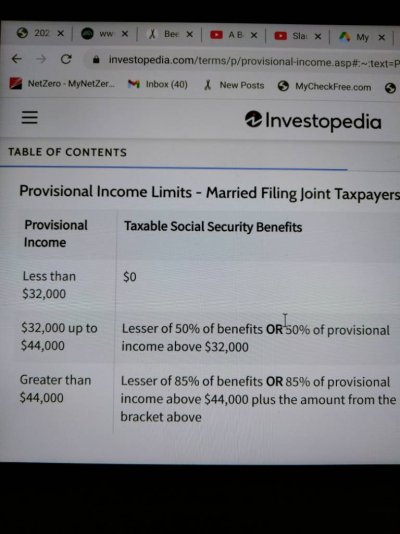

When Social Security was created in 1935, the Treasury Department said that our benefits would be Tax Free. Then in 1983 the Government created the laws that make up to 50% of our Benefits taxable, then in 1993 they moved that up to 85% of our benefits would become taxable. Each dollar of taxable income also makes 85 cents of your Social Security taxable, until 85% of your benefits are taxable.

This is all calculated on line 5 on your 1040 Tax Return!

Bottom line, if you take $100 out of your IRA, your taxable income increases by $185. 12% of $185 = $22.20, a 22.2% Federal tax rate, 22% of $185 = $40.70, a 40.7% Federal tax rate. But it is against Federal Law for your investment advisor to talk to you about this!

Also, at the top end of the 12% Federal Bracket when any LTCGs are becoming taxable at 15%, the total of 27% of $185 = $49.95, a 49.95% Federal Tax Rate.

And, if instead of taking $100 out of your IRA, if you earned it at a part time job, you can add $6.20 for SS Payroll Tax and $1.45 for Medicare Payroll Tax; for a total of $57.60 that the Federal Government will want to take from your $100 paycheck!

Good luck getting anyone to talk to you about these taxes. It is against the law for your broker to talk to you about your taxes, AARP refuses to publish anything about this unless I stand behind everything, and I’m not a tax accountant, and Turbo Tax refuses to talk to me!

My advice to you is to learn how to do your personal taxes, then start doing your taxes in January! Don’t start last year’s taxes, start your current year’s taxes so you know at what dollar amount your will cross over from the 22.2% marginal tax rate into the 40.7% or 49.95% marginal tax rate!