24601NoMore

Thinks s/he gets paid by the post

- Joined

- Dec 8, 2015

- Messages

- 1,166

Curious if anyone is buying into the Rivian (RIVN) IPO today.

I have a nephew that works in Engineering there who's pretty excited about the IPO and things in general..no inside info, though (and wouldn't share if I did).

Seeing pre-open that it's already expected to open at $125+ even though offer price was initially $78/share.

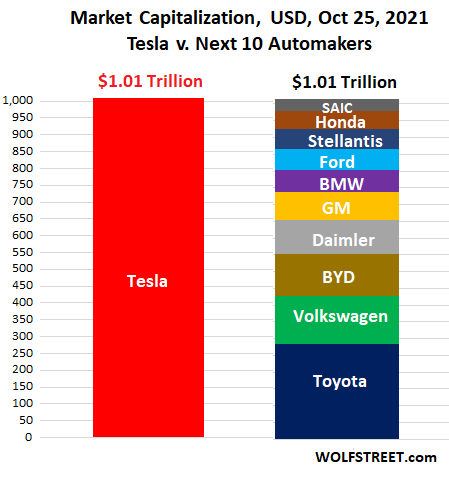

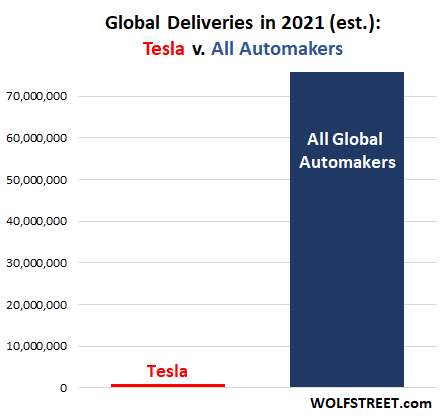

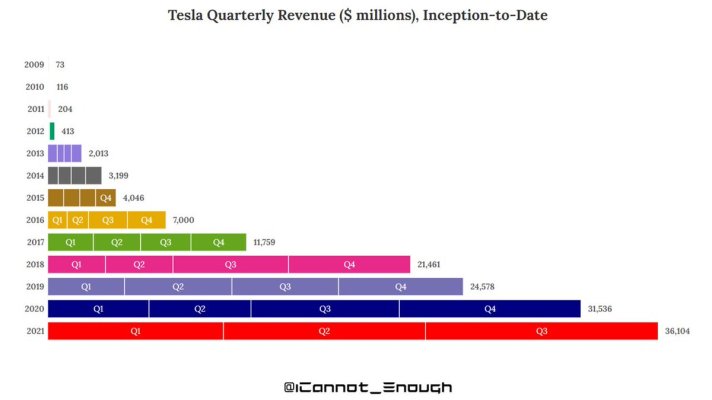

At $78/share, that'd be a $66B market cap - compared to Ford at around $79B and GM at $85B. All that with Q3 revenues projected at ~$1M with a $1B+ net loss.

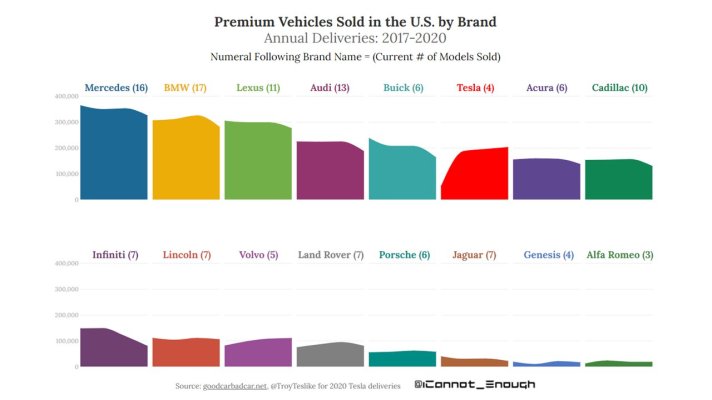

Seems like RIVN will be one of those stocks that gets totally unmoored from underlying fundamentals and instead is a purely speculative buy - just like Tesla, Amazon, etc.

I'm sitting this out based on "foofy" valuations but will probably regret it..

I have a nephew that works in Engineering there who's pretty excited about the IPO and things in general..no inside info, though (and wouldn't share if I did).

Seeing pre-open that it's already expected to open at $125+ even though offer price was initially $78/share.

At $78/share, that'd be a $66B market cap - compared to Ford at around $79B and GM at $85B. All that with Q3 revenues projected at ~$1M with a $1B+ net loss.

Seems like RIVN will be one of those stocks that gets totally unmoored from underlying fundamentals and instead is a purely speculative buy - just like Tesla, Amazon, etc.

I'm sitting this out based on "foofy" valuations but will probably regret it..