daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

OP said things work out with a zero return. AA also reflects risk preferences. Some folks in MercyMe’s situation might justifiably decide that they don’t need a high expected return, so why take on more risk?

Edit: I just did some math. With a 3.6% inflation rate and a zero nominal return, you need 90x for a 40 year retirement and 140x for 50 years. That is a lot.

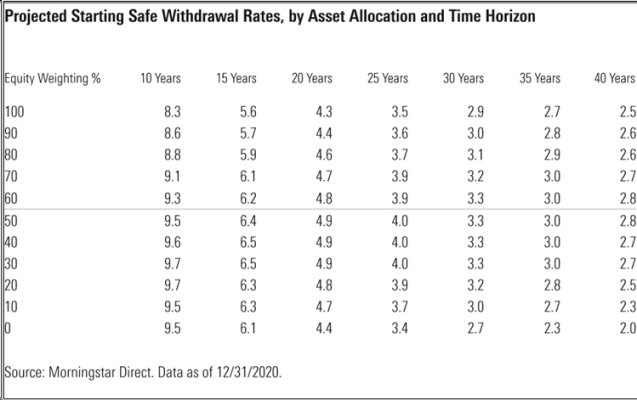

With a zero real return, the safe withdrawal rate is 3.3% over 30 years, or 4% for 1.3%. TIPS real yields have been rising with the interest rate hikes and are currently at -.08% to .64% real returns, based on CPI inflation. That is with just the Fed increases so far this year, and they had 6 total increases penciled out as of March.