Actually those funds will be available for you to withdraw tax-free immediately. Not that you will likely want to do that, but you could.

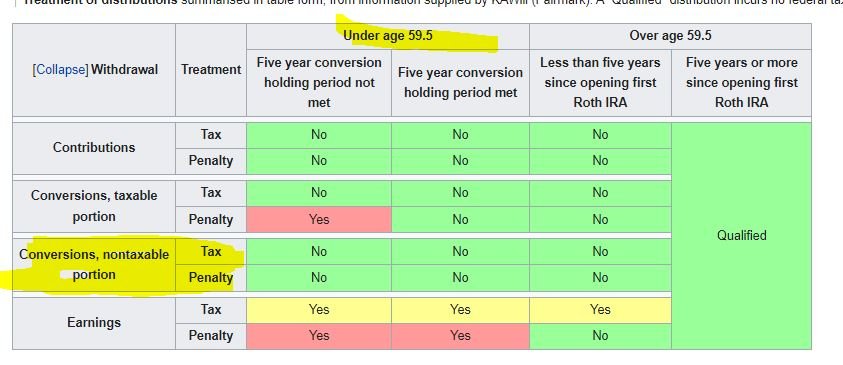

See the distribution rules in

table form: the amount put into Roth via the backdoor process is "Conversions, nontaxable portion".

If your contribution earns a couple of dollars in the traditional account so, for example, you contribute $6000 but end up converting $6002, the $2 would be taxable for the conversion year. Should you then take a withdrawal from the Roth, that $2 would be "Conversions, taxable portion" and subject to a 10% penalty. You would thus be liable to pay $2 * 10% = $0.20, but that rounds down to $0.