Car-Guy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

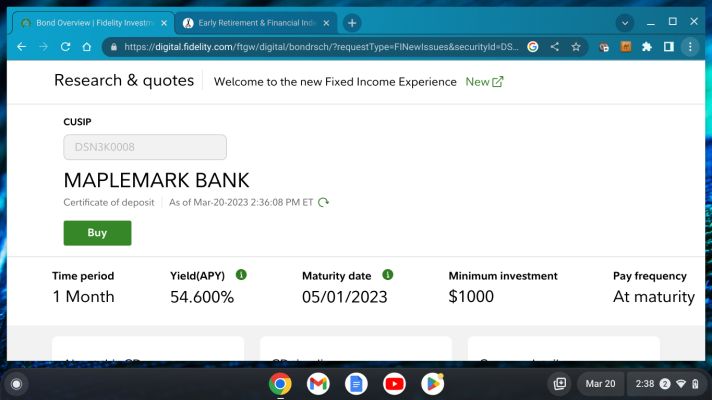

No I don't care as long as they are FDIC insured and I stay under the 250k aggregate per bank....That's what I've been doing.How critical are the bank ratings on these cd purchases? If you’re under $250K should you care? I was looking at the Schwab offerings. Under $250K just choose the highest return?

NOTE: I personally do look at the issuing banks websites and would stay away from those that claim to be big in (mention) Cyber Currency, but other than that, they are all pretty much to same to me. YMMV

Last edited: