stephenson

Thinks s/he gets paid by the post

- Joined

- Jul 3, 2009

- Messages

- 1,611

Thanks, audreyh1!

I've got some extra cash right now - equities are scary with debt crisis, well, I guess so is everything else.

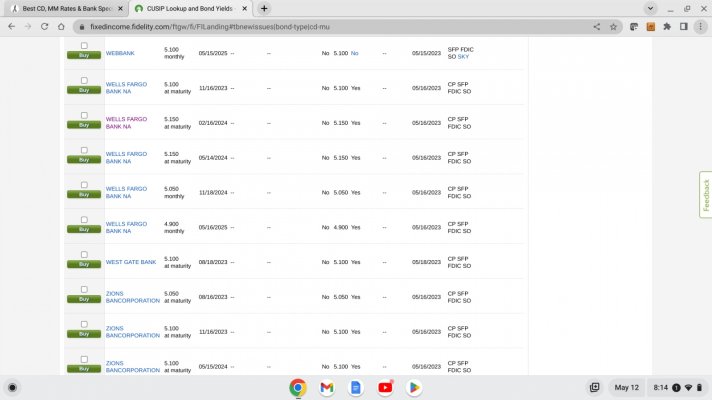

SPAXX is about 4.77 (7 day), CDs 5 ish? IBonds 4.3?

I've got some extra cash right now - equities are scary with debt crisis, well, I guess so is everything else.

SPAXX is about 4.77 (7 day), CDs 5 ish? IBonds 4.3?