mistermike40

Recycles dryer sheets

- Joined

- Aug 6, 2014

- Messages

- 382

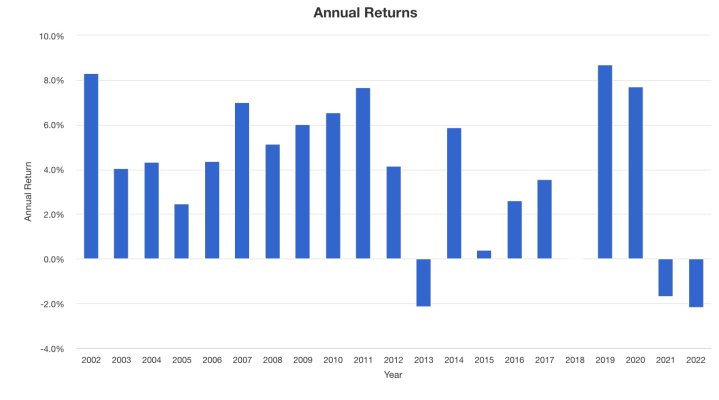

I don't understand everything about bond funds (ok, I don't understand very much at all about them), but I was shocked to see how much of a hit mine took in the first six weeks of 2022. I would actually be very happy with 0% at this point.

It's in my 401k, and I've already made my annual withdrawal (to the top of the 12% tax bracket). So, withdrawing a large chuck and putting it in an online savings account isn't really an option (I *really* don't want to pay 22%+ to move it out of the 401k).

Any ideas regarding this situation, or any thoughts on the future of bond funds? There's no cash option, or other non-equity place to move it to (within my 401k). I'm guessing performance will be even worse as Fed increases interest rates...

It's in my 401k, and I've already made my annual withdrawal (to the top of the 12% tax bracket). So, withdrawing a large chuck and putting it in an online savings account isn't really an option (I *really* don't want to pay 22%+ to move it out of the 401k).

Any ideas regarding this situation, or any thoughts on the future of bond funds? There's no cash option, or other non-equity place to move it to (within my 401k). I'm guessing performance will be even worse as Fed increases interest rates...

Last edited: