The Eagle has landed!

A lot to pack in there.

Generally fixed income should be held in tax-deferred accounts because interest is ordinary income just like tax-deferred withdrawals are. If you hold equities in tax-deferred account it effectively converts qualified dividends and long-term capital gains from preferenced income to ordinary income.

Conversely, equities should be held in taxable accounts where possible because qualified dividends and long-term capital gains get preferential tax rates. Foreign equities are best held in taxable accounts because you can then use the foreign tax credit, which is lost for foreign equities held in tax-deferred and tax-free accounts.

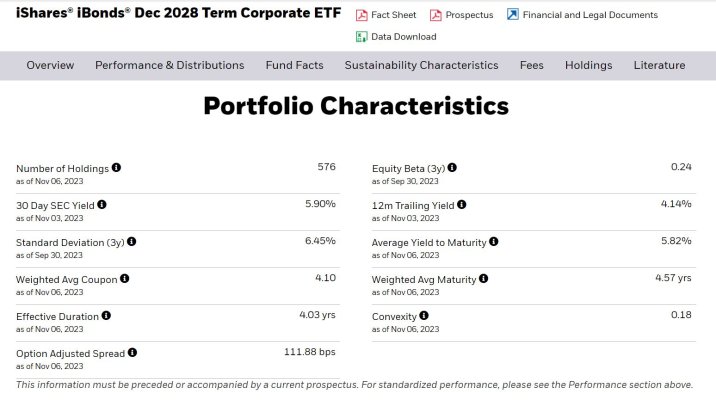

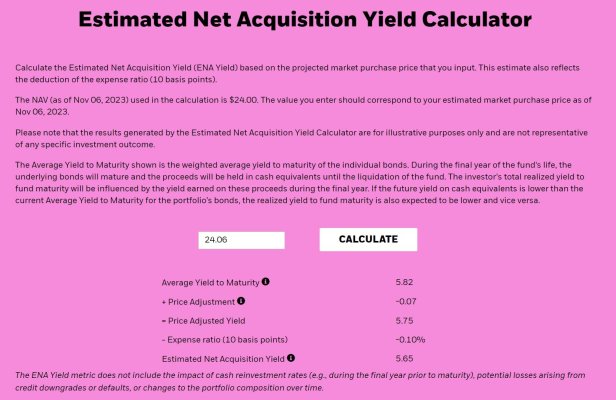

I agree with your preference for individual bonds vs bond funds. While I hold individual bonds, I think the target maturity bond ETFs are a good choice for those who eschew bond funds but want simplification and diversification. These ETFs invest in stated categories of bonds that all mature in a stated year... in December of the maturity year there is a terminal distribution to the ETF holders and then the fund is done... akin to receiving the par value of an individual bond at maturity. Since the ETF holds hundreds of bonds, you have good diversification. (I don't currently own any of these but have owned both BlackRock iBonds and Invesco Bulletshares in the past). They offer Treasury, corporate, high yield and muni versions. Since diversification of credit risk isn't necessary for Treasuries, I think individual holdings are preferable for Treasuries.

It is fine to hold Treasuries in an tIRA. No reason to not hold munis if the yield is right or there are also taxable munis that would be appropriate for an tIRA.

Almost 1/3 of my fixed income are agency bonds... issued by GSEs... government sponsored entities like the Federal Home Loan Bank, Federal Farm Credit Bureau, et al... usually Aaa by Moody's and AA+ by S&P and IMO just a baby-step down from Treasuries with repect to credit risk.

Another 1/3 are in brokered CDs that are FDIC insured. These are issued by FDIC insured banks and sold through brokers. As long as you stay below the FDIC limits for any single issuing bank then you are fully protected from default risk.

I have a "trick" for not worrying about income. I have an online savings account that is the "gatekeeper" between my investment accounts and the checking account that I use to pay my bills. I have an automatic monthly "paycheck" transfer from this account to checking and periodically do other transfers to cover lumpy expenses like property taxes, insurance, etc. I have a target of having a year's worth of paycheck and $25k safety stock when I replenish the gatekeeper, which I do periodically from taxable account cash flow. The online saving account yields 4.3%. With this mechanism in place I don't have to limit myself to monthly payers or I can freely invest in lower coupon bonds that trade at a discount. I often look out for callable bonds where the coupon is 3% or lower since I think they are unlikely to be called that trade at a good discount and YTM.