I will have to take my 1st withdrawal in 2024. I have tapped my IRA once since we retired and that time I just had Fidelity to take out 10% more to send to uncle for tax. Since then reading some here I think mabey that wasn't too smart. so what is best way to do the withdrawal? my ist one is 2024 and then my DW will be 2025. Opinions on time to take and how much will be appreciated,because I know some of y'all are very experienced: Thanks!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Born March 1952 When to take RMD?

- Thread starter Venturer

- Start date

TheWizard

Thinks s/he gets paid by the post

Take out 1/12th of your RMD on the 15th of each month, drawn pro rata from your mix of investments.

Cheers...

Cheers...

frayne

Thinks s/he gets paid by the post

I don't think you are required to take your RMD until 2025 but feel free to double check me on this. I've been a FIDO customer for five decades. I have been tapping my T-IRA for the last eighteen years (did a 72T back in the day) and basically I have FIDO deposit a monthly amount in my checking account and I also have them withhold 10% on an annual basis to cover my future tax liability. Actually very easy to set up or change as needed as your portfolio dictates.

Last edited:

Car-Guy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I don't think you are required to take your RMD until 2025. Feel free to double check me on this.

+1, correct for the OP. (Or 2026 if he wants to take it twice and play that game for his first year) IIRC

Last edited:

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Interesting. Would you say the 1st of month would work just as well?Take out 1/12th of your RMD on the 15th of each month, drawn pro rata from your mix of investments.

Cheers...

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

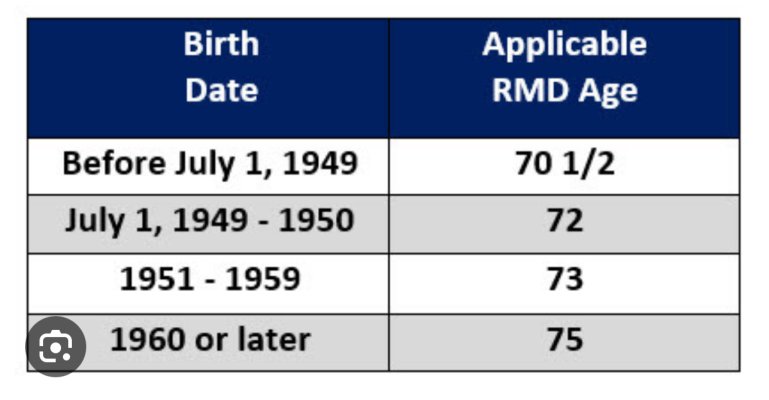

"Individuals who were born between 1951 and 1959 will need to start their RMDs after age 73"

https://money.usnews.com/money/retirement/401ks/articles/new-rmd-rules-for-2023

https://money.usnews.com/money/retirement/401ks/articles/new-rmd-rules-for-2023

TheWizard

Thinks s/he gets paid by the post

I don't think your first RMD is until 2025.

Correct, the year he turns 73.

Nonetheless, I prefer to think of those tax-deferred accounts for what they really are: Deferred Compensation.

They're not the same sort of wealth that taxable accounts are and don't pass to beneficiaries with stepped up basis.

So I feel it best to withdraw that money similar to how it was when working, as monthly income...

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

A SPIA would do it for you, provide a monthly income that is. Could do one with a payout when one passes, or 15-, 20- or 25-year period certain if leaving a legacy is a priority, otherwise open a SPIA (A++ Company) and never worry about it again.

Last edited:

TheWizard

Thinks s/he gets paid by the post

Interesting. Would you say the 1st of month would work just as well?

Quite possibly, yes.

In my case, I have pension/annuity income hitting my checking account on the first, so I stagger my RMD income by a couple weeks.

YMMV, as someone once said...

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Wait. Under the new rules you shouldn’t have RMD until 2025 , the year you turn 73. Once you get the starting year figured out there are lots of ways to satisfy the requirement. I don’t see an issue with how you did it before. Make sure you know how to calculate your RMD. Fidelity does this for me but they can’t calculate based on funds in outside accounts.

https://www.irahelp.com/slottreport/ira-rmd-age-made-easy

https://www.irahelp.com/slottreport/ira-rmd-age-made-easy

frayne

Thinks s/he gets paid by the post

Correct, the year he turns 73.

Nonetheless, I prefer to think of those tax-deferred accounts for what they really are: Deferred Compensation.

They're not the same sort of wealth that taxable accounts are and don't pass to beneficiaries with stepped up basis.

So I feel it best to withdraw that money similar to how it was when working, as monthly income...

Exactly.

latexman

Thinks s/he gets paid by the post

EastWest Gal

Thinks s/he gets paid by the post

According to Schwab:

Your first RMD must be taken by 4/1 of the year after you turn 73. Subsequent RMDs must be taken by 12/31 of each year. If you don't take your RMD, you'll have to pay a penalty, follow the IRS guidelines and consult your tax advisor.

Italics mine.

Your first RMD must be taken by 4/1 of the year after you turn 73. Subsequent RMDs must be taken by 12/31 of each year. If you don't take your RMD, you'll have to pay a penalty, follow the IRS guidelines and consult your tax advisor.

Italics mine.

bada bing

Full time employment: Posting here.

+1, correct for the OP. (Or 2026 if he wants to take it twice and play that game for his first year) IIRC

That's the right answer, but there's one additional wiggle. If you choose to wait to start until the year after you turn 73, you have to take two rmds that first year and the first one has to happen on/before April 1.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

+1. First RMD for the OP born Mar 1952 would be 4/1/2026. Direct from the IRS...According to Schwab:

Your first RMD must be taken by 4/1 of the year after you turn 73. Subsequent RMDs must be taken by 12/31 of each year. If you don't take your RMD, you'll have to pay a penalty, follow the IRS guidelines and consult your tax advisor.

Italics mine.

https://www.irs.gov/retirement-plan...nt-topics-required-minimum-distributions-rmdsIRS said:Required beginning date for your first RMD

- IRAs (including SEPs and SIMPLE IRAs)

- April 1 of the year following the calendar year in which you reach age 72 (73 if you reach age 72 after Dec. 31, 2022).

Last edited:

Out-to-Lunch

Thinks s/he gets paid by the post

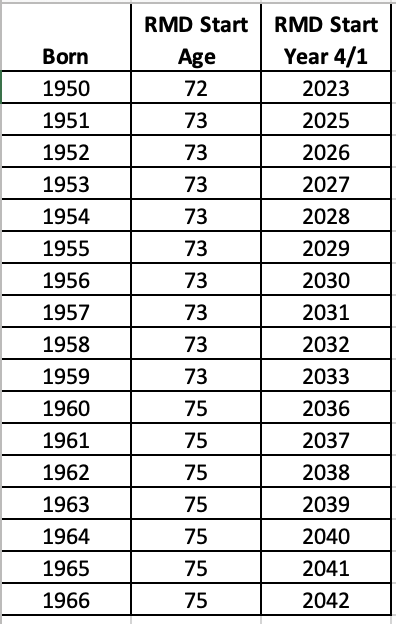

Why can't we find a table like this?

(I made this, so consider the source.)

Edit: Midpack tells me that I am off by a year. But I was not intending to make the distinction between the Apr.1 date and the year you attain RMD age. How about this revised version:

(I made this, so consider the source.)

Edit: Midpack tells me that I am off by a year. But I was not intending to make the distinction between the Apr.1 date and the year you attain RMD age. How about this revised version:

| birth | RMDAge | RMDstart(Apr) |

| 1949 | 2021 | 2022 |

| 1950 | 2022 | 2023 |

| 1951 | 2024 | 2025 |

| 1952 | 2025 | 2026 |

| 1953 | 2026 | 2027 |

| 1954 | 2027 | 2028 |

| 1955 | 2028 | 2029 |

| 1956 | 2029 | 2030 |

| 1957 | 2030 | 2031 |

| 1958 | 2031 | 2032 |

| 1959 | 2032 | 2033 |

| 1960 | 2035 | 2036 |

| 1961 | 2036 | 2037 |

| 1962 | 2037 | 2038 |

| 1963 | 2038 | 2039 |

| 1964 | 2039 | 2040 |

| 1965 | 2040 | 2041 |

| 1966 | 2041 | 2042 |

| 1967 | 2042 | 2043 |

| 1968 | 2043 | 2044 |

Last edited:

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

According to Schwab:

Your first RMD must be taken by 4/1 of the year after you turn 73. Subsequent RMDs must be taken by 12/31 of each year. If you don't take your RMD, you'll have to pay a penalty, follow the IRS guidelines and consult your tax advisor.

Italics mine.

Yes, but since that means a double whammy the year after you turn 73 most folks take the first RMD the year they turn 73.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

frayne

Thinks s/he gets paid by the post

Yes, but since that means a double whammy the year after you turn 73 most folks take the first RMD the year they turn 73.

Amen

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Why can't we find a table like this?

(I made this, so consider the source.)n:

[]

I know, right. This is what I was looking for (or something equally simple) but it’s like they want it to be overly complicated. I think it is more confusing to account for the year 1 deadline extension. It is still for the year you turn 73. Better to be conservative. Thanks for your effort.

Would the timing of the withdrawal depend on when you are going to spend it?

I've got several years left so don't have experience, but from what I've read on these forums, some people pull the whole RMD in December to prep having money for the coming year.

Though, I'm not sure that is the best way, because presumably that means they have a year RMD amount sitting and growing taxable interest while they whittle it down spending over the next year.

I've got several years left so don't have experience, but from what I've read on these forums, some people pull the whole RMD in December to prep having money for the coming year.

Though, I'm not sure that is the best way, because presumably that means they have a year RMD amount sitting and growing taxable interest while they whittle it down spending over the next year.

Out-to-Lunch

Thinks s/he gets paid by the post

I know, right. This is what I was looking for (or something equally simple) but it’s like they want it to be overly complicated. I think it is more confusing to account for the year 1 deadline extension. It is still for the year you turn 73. Better to be conservative. Thanks for your effort.

Thank you.

2038 is a long way off, but at this moment in time I can't imagine intentionally pulling two RMDs in the same year, when it could so easily be avoided.

TheWizard

Thinks s/he gets paid by the post

Thank you.

2038 is a long way off, but at this moment in time I can't imagine intentionally pulling two RMDs in the same year, when it could so easily be avoided.

If you were selling a rental property in your first year of RMDs, it could make good sense to delay that first RMD...

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Or if you wanted to squeeze in one last larger Roth conversion before starting RMDs. There are cases for and against as usual.2038 is a long way off, but at this moment in time I can't imagine intentionally pulling two RMDs in the same year, when it could so easily be avoided.If you were selling a rental property in your first year of RMDs, it could make good sense to delay that first RMD...

Similar threads

- Replies

- 12

- Views

- 1K