Kings over Queens

Recycles dryer sheets

- Joined

- Apr 16, 2023

- Messages

- 437

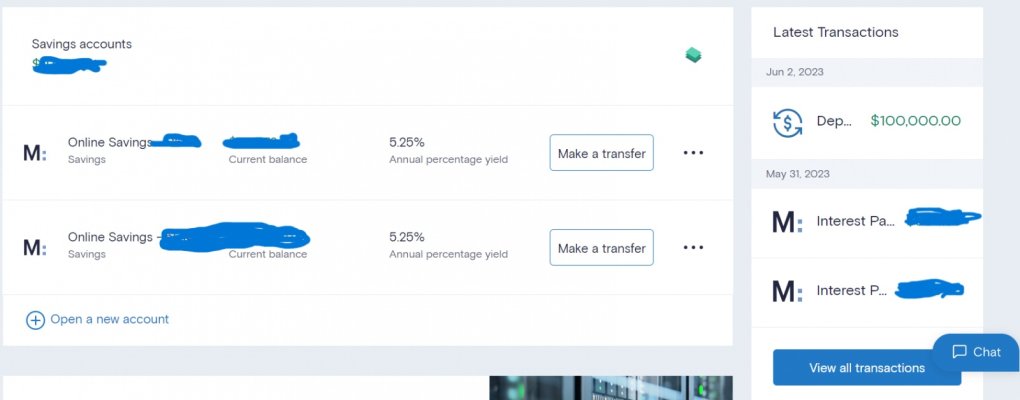

We were at a BBQ last weekend and my Uncle mentioned Marcus paying over 4% on his savings account. I was happy with 3 and change at Discover, then he mentioned a bonus if he refers me. Just opened the account, good for over 5% for 3 months.

I've never really bounced around accounts, or even investments for that matter. Slow and steady wins the race, but it seems that taking a more active or observant role in money is the thing to do during retirement? not that I "fired," yet, but am close.

Is that "normal" for lack of a better term?

I've never really bounced around accounts, or even investments for that matter. Slow and steady wins the race, but it seems that taking a more active or observant role in money is the thing to do during retirement? not that I "fired," yet, but am close.

Is that "normal" for lack of a better term?