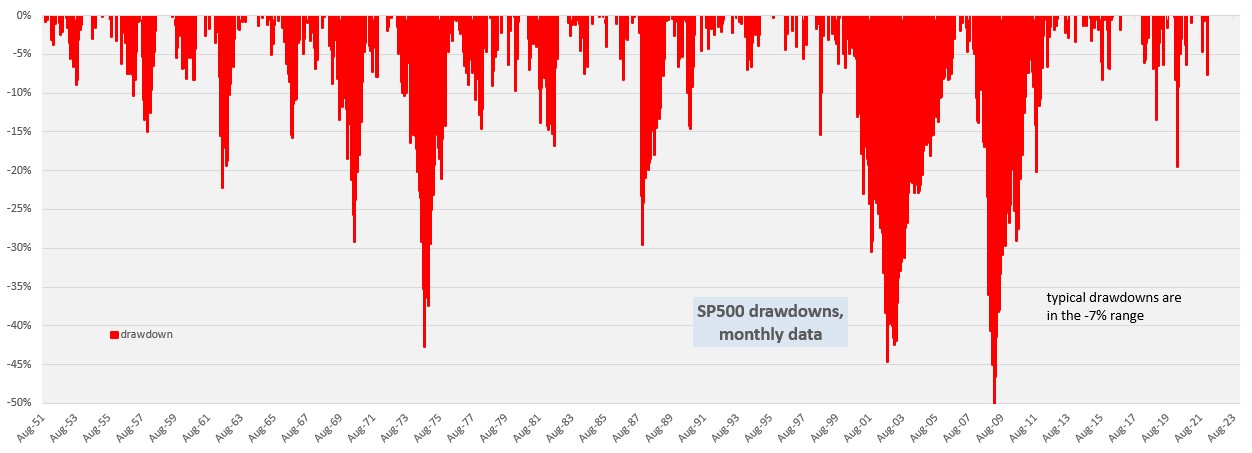

Great chart corn18.

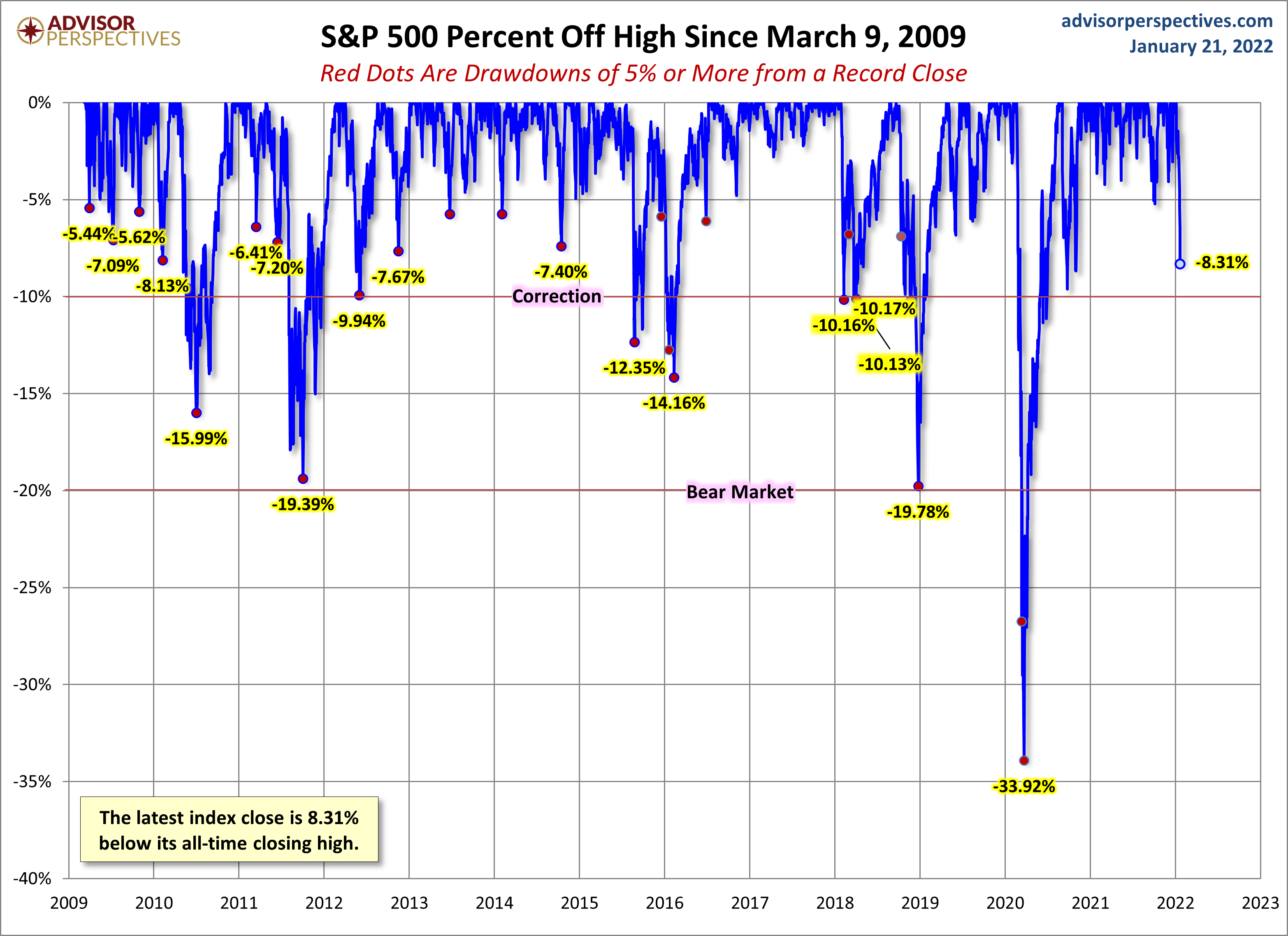

Its too easy for people to forget we have had multiple 20% pullbacks in the last few years and its a good illustration of how quickly they were over (which I believe is by the vast amount of machine trading)...once the chart says to buy, they just all buy and the dip is over in an instant.

Its too easy for people to forget we have had multiple 20% pullbacks in the last few years and its a good illustration of how quickly they were over (which I believe is by the vast amount of machine trading)...once the chart says to buy, they just all buy and the dip is over in an instant.