There is no actual 2023 average wage index factor yet, it can only be estimated at this time.

The 2021 average wage index and the 2020 average wage index factor (to bring 2020 wages to 2021 levels) were determined this year.

The bend points for 2023 were determined using the 2022 bend point and multiplying them by the new 2020 factor (the last determined).

Factors for 2021 and 2022 will not be determined until 2023 and 2024 respectively.

If she turns 62 in 2025, the 2023 and 2024 factors will be determined in 2025 and 2026, too late for her and will not affect her PIA. COLA adjustments will take over in 2025. The factors for 2023 and 2024 will be 1.0 (no change).

See

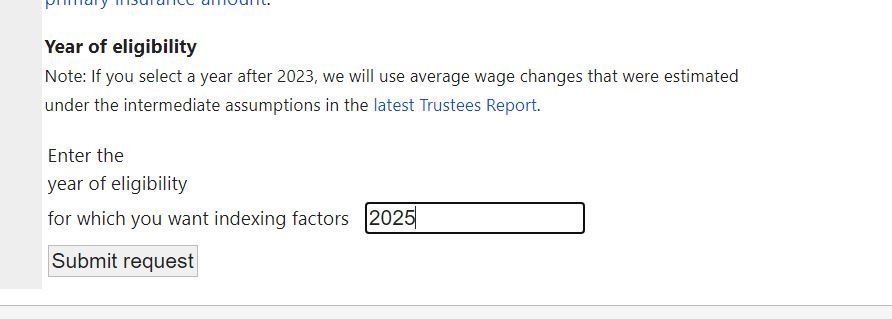

https://www.ssa.gov/cgi-bin/awiFactors.cgi and put in 2025 as the first year of eligibility. The factors for 2021 and 2022 will be estimates since 2021 is the last average wage index determined. Edit: Actually, all the factors will be off by however much those last estimates are off.