urn2bfree

Full time employment: Posting here.

- Joined

- Feb 14, 2011

- Messages

- 853

Forgive me if I am missing some simple answer to this, but it makes my head hurt to even try to figure it out.

Dividends are wonderful. Dividends are the rocket fuel that propel our portfolios. They have favorable tax status- and depending on how big they are and where they are (Roth), dividends can be completely and totally tax free.

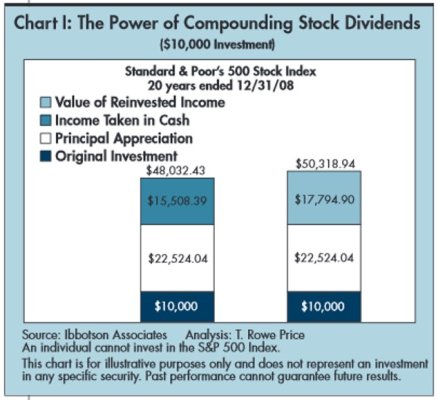

That makes dividends a wonderful part of our lives, but doesn't that make them a fly in the ointment of any calculations? My understanding is that with an S&P 500 index, 89% of long term gains are from reinvestment of dividends. How can the calculators account for this?

We are not doing any withdrawing yet. Our accounts have the majority of dividends paid and re-invested in taxable accounts. We have no Roth accounts. With my wife still working and me having a sizable traditional IRA, we would take a big haircut on any money I tried to put in a Roth right now. So our account is growing as one would expect-firing on all cylinders, if you will.

But what happens when we truly FIRE-- and we take away that dividend rocket fuel?

Once my wife stops working we will be drawing down and having to use portfolio funds to pay taxes and our other living expenses. With no external source of $$ in the DeAccumulation phase, the dividends are not being reinvested. But without dividends to be intermittently pumped into the portfolio, we will miss out on 89% of the historical gains. Retirement calculators like FIRECalc use historical gains. I guess Monte Carlo situations can be set at lower gain levels, but are they set 89% lower? Besides sequence of returns risk, isn't loss of the dividend bounce a threat to any portfolio's survival?

Sent from my iPad using Early Retirement Forum

Dividends are wonderful. Dividends are the rocket fuel that propel our portfolios. They have favorable tax status- and depending on how big they are and where they are (Roth), dividends can be completely and totally tax free.

That makes dividends a wonderful part of our lives, but doesn't that make them a fly in the ointment of any calculations? My understanding is that with an S&P 500 index, 89% of long term gains are from reinvestment of dividends. How can the calculators account for this?

We are not doing any withdrawing yet. Our accounts have the majority of dividends paid and re-invested in taxable accounts. We have no Roth accounts. With my wife still working and me having a sizable traditional IRA, we would take a big haircut on any money I tried to put in a Roth right now. So our account is growing as one would expect-firing on all cylinders, if you will.

But what happens when we truly FIRE-- and we take away that dividend rocket fuel?

Once my wife stops working we will be drawing down and having to use portfolio funds to pay taxes and our other living expenses. With no external source of $$ in the DeAccumulation phase, the dividends are not being reinvested. But without dividends to be intermittently pumped into the portfolio, we will miss out on 89% of the historical gains. Retirement calculators like FIRECalc use historical gains. I guess Monte Carlo situations can be set at lower gain levels, but are they set 89% lower? Besides sequence of returns risk, isn't loss of the dividend bounce a threat to any portfolio's survival?

Sent from my iPad using Early Retirement Forum