MichealKnight

Full time employment: Posting here.

- Joined

- May 2, 2019

- Messages

- 520

Hello Everybody.... was hoping to get some opinions.

I have some cash (400k) that I've sort of earmarked to start being used, 4 years - 5 yearsfrom today. This money will be part living expenses, part college expenses. And I'm mulling where to put these funds - where of course there's minimal risk - but with chance of decent returns. Decent is subjective - in this case - at least beating CD's....but not investing in ARK funds

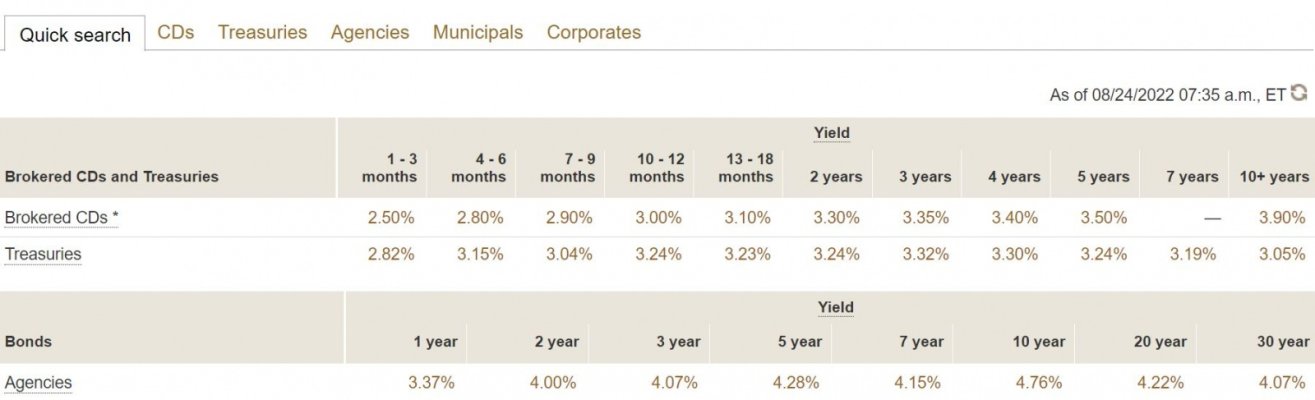

CD: Approx 3.65%

***************

Keep it simple, it's locked up for 4-5 years and 3.65 doesn't look horrible.

MUNI: 2.94% Yield

***************

VPAIX for Pennsylvania. If I do the 2.94% - with zero taxes..... the total balance at the and is within 1% of CD. I feel that I'm adding risk for no return.

HOWEVER, is it possible rates start to drop next year? If so - would I vet some price appreciation because if so - then it beats CDs. They say these are 6-10 year durations. FWIW - the VPAIX share price - is 7% less than what it was pre-pandemic.

VWINX Wellesley

*************

Bond-Heavy - but not wild junk stuff. 7.4 year duration avg.

Stocks - as everyone here knows - Blue Chip stuff. Doesn't mean they don't go down, but to me it just means - there's lesser risk than investing in ZOOM-ish stuff.

Again if rates drop a bit or even level off - then would that not be good for the bond appreciation? Also, as an admitted layman I'm looking at their bonds -- - Amazon, BMW credit, BOA, Comcast - I dunno - it maybe simplistic but I foresee those guys, paying their bills.

Right now, I feel like putting 70% into CDs @3.65% - - and 30% into VWINX feels suitable. (maybe wait a few months and 3.65 goes to 3.9?)

I've done the cursory $20k in I-BONDS

Would really appreciate any opinions or ideas, even question, comments and insults are good too.

I have some cash (400k) that I've sort of earmarked to start being used, 4 years - 5 yearsfrom today. This money will be part living expenses, part college expenses. And I'm mulling where to put these funds - where of course there's minimal risk - but with chance of decent returns. Decent is subjective - in this case - at least beating CD's....but not investing in ARK funds

CD: Approx 3.65%

***************

Keep it simple, it's locked up for 4-5 years and 3.65 doesn't look horrible.

MUNI: 2.94% Yield

***************

VPAIX for Pennsylvania. If I do the 2.94% - with zero taxes..... the total balance at the and is within 1% of CD. I feel that I'm adding risk for no return.

HOWEVER, is it possible rates start to drop next year? If so - would I vet some price appreciation because if so - then it beats CDs. They say these are 6-10 year durations. FWIW - the VPAIX share price - is 7% less than what it was pre-pandemic.

VWINX Wellesley

*************

Bond-Heavy - but not wild junk stuff. 7.4 year duration avg.

Stocks - as everyone here knows - Blue Chip stuff. Doesn't mean they don't go down, but to me it just means - there's lesser risk than investing in ZOOM-ish stuff.

Again if rates drop a bit or even level off - then would that not be good for the bond appreciation? Also, as an admitted layman I'm looking at their bonds -- - Amazon, BMW credit, BOA, Comcast - I dunno - it maybe simplistic but I foresee those guys, paying their bills.

Right now, I feel like putting 70% into CDs @3.65% - - and 30% into VWINX feels suitable. (maybe wait a few months and 3.65 goes to 3.9?)

I've done the cursory $20k in I-BONDS

Would really appreciate any opinions or ideas, even question, comments and insults are good too.

) in this over last 24-36mo, now at 285k after being up to 310k. It's not needed for 4-5yr after I turn 59.5 and other funds will also be available. These funds do move both ways and spit off lots of dividends. Once our income drops this won't be such a problem.

) in this over last 24-36mo, now at 285k after being up to 310k. It's not needed for 4-5yr after I turn 59.5 and other funds will also be available. These funds do move both ways and spit off lots of dividends. Once our income drops this won't be such a problem.