MichealKnight

Full time employment: Posting here.

- Joined

- May 2, 2019

- Messages

- 520

I posted similar once before and I thought it was a quality discussion hence I'll do it again. Actually got a lovely email from someone saying they always wanted to ask this but were shy so I guess I'm the Union Steward of the Yum-Yum section of the class.

I am *not* trying to be lazy and not do homework. This is not "tell me if I should buy these bonds".....this is more about, I am trying to learn how experienced bond investors look at a bond and decide whether to invest or not. So here goes....

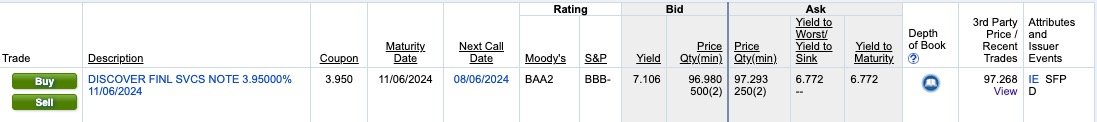

1.)Discover Financial

254709AK4/ US254709AK45

Baa2 Moody. BBB-S&P

Price: 97.264............ 6.803 YTM. 6.803 YTW

Price: 96.995 (written in red). 7.204

Callable 8/24@100

Maturity: 11/24

2.)Capital One Fin Corp

14040HBT1/ US14040HBT14

Baa1/ BBB

Price: 97.003......................6.468 YTM. 6.468 YTW

Price: 96.863 (in red)

Callable 9/24@100

Maturity: 10/30/24@100

The "written in red' numbers I can't figure out what that refers to.

But as a card-carrying layman....... I interpret the above as:

Ok, loan money to Capital One. As long as I don't sell it before 9/24...... on 9/24 they will have bought my bonds back@100....and that, plus the coupon rate I get.....will mean I got an annualized return of 6.48%

So again fully admitting I'm a layman.....I conclude that ok....so I'm getting 5.3-5.5 for no risk gov't bonds. No state tax (PA 3%)so effectively it's perhaps 5.7%

So it's 0.70%-1.00% MORE in return for taking a risk.

Not much risk premium but I am asking myself: Just really how much is the risk? Yes, Discover has had problems but I don't see Discover going bankrupt any time soon.

Ditto, Capital One. Ok, people default on credit cards and car loans but how is that enough to put in under anytime soon?

Hence - it's only 1% more return - but if I'm betting on Discover or CapOne being around a few more years I sort of feel my only risk is something cataclysmic a la Countrywide Mortgages.

Would love to hear people's thought process here. Thanks.

I am *not* trying to be lazy and not do homework. This is not "tell me if I should buy these bonds".....this is more about, I am trying to learn how experienced bond investors look at a bond and decide whether to invest or not. So here goes....

1.)Discover Financial

254709AK4/ US254709AK45

Baa2 Moody. BBB-S&P

Price: 97.264............ 6.803 YTM. 6.803 YTW

Price: 96.995 (written in red). 7.204

Callable 8/24@100

Maturity: 11/24

2.)Capital One Fin Corp

14040HBT1/ US14040HBT14

Baa1/ BBB

Price: 97.003......................6.468 YTM. 6.468 YTW

Price: 96.863 (in red)

Callable 9/24@100

Maturity: 10/30/24@100

The "written in red' numbers I can't figure out what that refers to.

But as a card-carrying layman....... I interpret the above as:

Ok, loan money to Capital One. As long as I don't sell it before 9/24...... on 9/24 they will have bought my bonds back@100....and that, plus the coupon rate I get.....will mean I got an annualized return of 6.48%

So again fully admitting I'm a layman.....I conclude that ok....so I'm getting 5.3-5.5 for no risk gov't bonds. No state tax (PA 3%)so effectively it's perhaps 5.7%

So it's 0.70%-1.00% MORE in return for taking a risk.

Not much risk premium but I am asking myself: Just really how much is the risk? Yes, Discover has had problems but I don't see Discover going bankrupt any time soon.

Ditto, Capital One. Ok, people default on credit cards and car loans but how is that enough to put in under anytime soon?

Hence - it's only 1% more return - but if I'm betting on Discover or CapOne being around a few more years I sort of feel my only risk is something cataclysmic a la Countrywide Mortgages.

Would love to hear people's thought process here. Thanks.