pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

If a new issue bond is immediately callable, that is a non-starter for me. And in that case the rate can't be high enough to compensate you, in my view, because you could get the money back in a month compared to 5 years for example.

Now, in the secondary market you may find callable bonds trading at a discount. In such cases the call feature is not an issue since it is unlikely to be called and you have a "cushion" between par and the purchase price. They have to pay you in order to call it or rates have to fall a lot (which also pays you in realizing the value more quickly).

Call them "cushion callables". They can make a lot of sense.

Now, some folks are trying to live off of their interest. These might not work as well there since coupons are much lower.

I sometimes look for these "cushion callables" and occasionally find one. I did a search for agency issues maturing in 2030 on Schwab. Best non-callable yield is 4.382%

| FFCB 4.25% 09/30/2030 | |||||||||||||

| 3133ENQ45 | 4.250 | 09/30/2030 | -- | Ask | 25 | 99.18248 | 25 | 357 | 4.382 | -- | 303.990 | 25,099.610 | View |

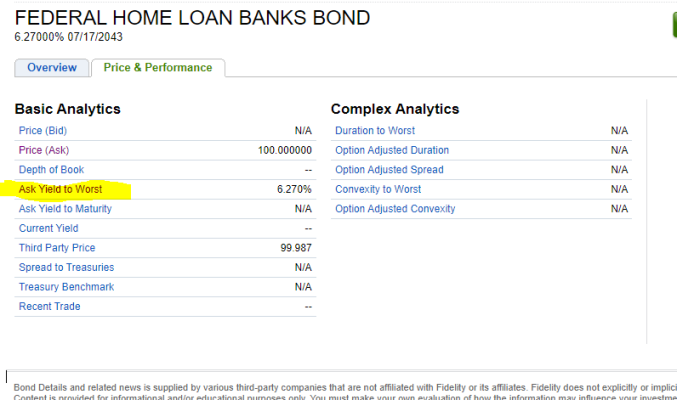

Change the search to callables maturing in 2030 and scan the list for a low coupon issue. There is a callable issue with a 1.28% coupon that is yielding 4.848%

| FEDERAL HOME LN MTG 1.28% 04/30/2030 Callable | |||||||||||||

| 3134GW3L8 | |||||||||||||

| 07/30/2023 @ 100.00000 | 1.280 | 04/30/2030 | Yes | Ask | 2 | 79.54600 | 2 | 2 | 4.848 | 4.848 | 5.190 | 1,596.110 | View |

I'll take the extra 47 bps given the negligible call risk. Easy money.

I don't need the cash flow so yield is more important to me than coupons.

Last edited: