Thanks for that. It's interesting seeing what they picked. You didn't post the amount of each bond purchased, so I wasn't able to match them up with market trade data - I was interested in seeing if the price they charged you was marked up by some amount.

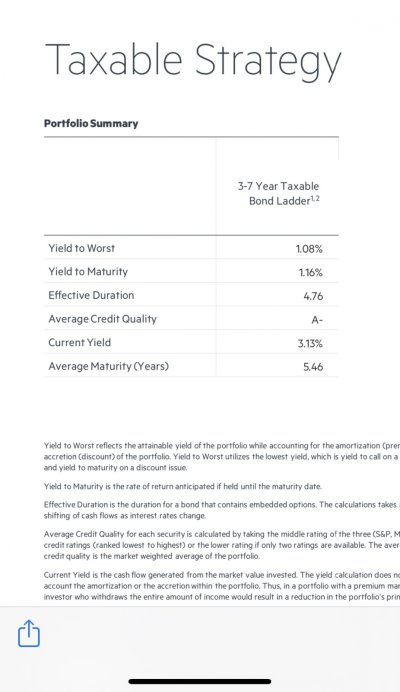

I popped it all in to the Fidelity price/yield calculator and the average YTM is 1.462%. That is just a straight raw average taking the YTM of each bond. To be more useful, I'm guessing it should be weighted by maturity. There are a few I wouldn't personally have purchased at both the high and low yields, but aside from that, it looks like a good mix considering what's available today.