You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

current best options for short-term fixed income

- Thread starter mrfeh

- Start date

Still Learning

Recycles dryer sheets

We have been happy with Federal Money Market Fund VMFXX through Vanguard and CDs through a local regional bank.

Money Market funds can be converted to a new investment quickly and our CDs are short, non-callable instruments.

Money Market funds can be converted to a new investment quickly and our CDs are short, non-callable instruments.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

You can simply compare the rates. Platforms like Fidelity let you compare across the board. For direct bank CDs, sites like depositaccounts.com do a good job of showing current rates.

Right now in general Treasury Bills are offering the highest rates for up to 6 months (26 weeks) offering 5.3-5.5%, and pretty competitive at 52 weeks as well.

For 12, 18 and 24 months CDs appear to be offering the best rates 5.3-5.4%. Brokered CDs specifically although some direct bank CDs may be competitive. You do have to watch out for call protection on the longer brokered CDs. At 12 months or higher this can reduce the rates a bit.

I’m only talking about no credit risk fixed income here.

Right now in general Treasury Bills are offering the highest rates for up to 6 months (26 weeks) offering 5.3-5.5%, and pretty competitive at 52 weeks as well.

For 12, 18 and 24 months CDs appear to be offering the best rates 5.3-5.4%. Brokered CDs specifically although some direct bank CDs may be competitive. You do have to watch out for call protection on the longer brokered CDs. At 12 months or higher this can reduce the rates a bit.

I’m only talking about no credit risk fixed income here.

Last edited:

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Brokerage:

1. Agency securities. Search secondary market for noncallables. Or find discounted callables, unlikely to be called. 5.2-5.4% in 18-20 mo range

2. discounted callable CDs on secondary mkt 5.0-5.2% in 18-20 mo range

3. Treasuries best for up to a year or so.

4. Money market funds around 5%.

Nonbrokerage

CDs and bank savings or MM accounts

1. Agency securities. Search secondary market for noncallables. Or find discounted callables, unlikely to be called. 5.2-5.4% in 18-20 mo range

2. discounted callable CDs on secondary mkt 5.0-5.2% in 18-20 mo range

3. Treasuries best for up to a year or so.

4. Money market funds around 5%.

Nonbrokerage

CDs and bank savings or MM accounts

Last edited:

SnowballCamper

Full time employment: Posting here.

- Joined

- Aug 17, 2019

- Messages

- 691

I just rolled over some maturing treasuries back into short term (all less than a year) for over 5%. The ladder builder in Schwab is pretty easy to use.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

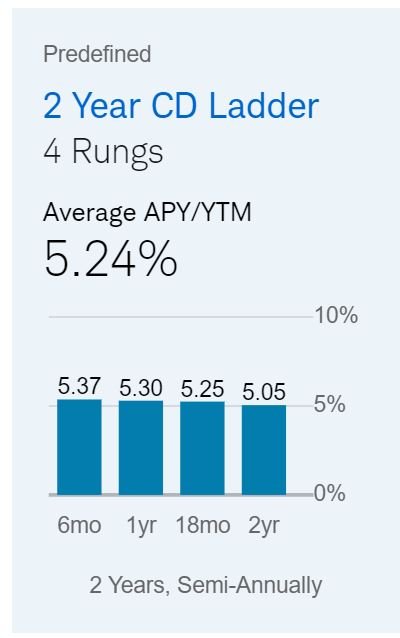

+1 Schwab's CD ladder tool indicates that a 2-year CD ladder would yield 5.24%. Or you could just put it in SWVXX which is currently yielding 4.96%.

Not a Schwab customer, but Fidelity has a similar mechanism. I'll check it out.

Correct. 5%/.95 is just over 5.26%.Somebody please check my logic regarding taxes when it comes to CDs vs treasuries...

If my state tax rate is 5% and a treasury returns 5%, I'd need a CD at roughly 5.25% to get the same return, correct?

Thanks.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

5.26 and change as Phroig calculated.

Of course that assumes you do not get a federal deduction for incremental state taxes (which is in fact the case for many of us).

But if you do and federal marginal rate is 20% for example then the math is 5/1-(.5-(.5*.2)) or approx 5.21.

Of course that assumes you do not get a federal deduction for incremental state taxes (which is in fact the case for many of us).

But if you do and federal marginal rate is 20% for example then the math is 5/1-(.5-(.5*.2)) or approx 5.21.

Not a Schwab customer, but Fidelity has a similar mechanism. I'll check it out.

What is Fidelity mechanism?

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

+1 Schwab's CD ladder tool indicates that a 2-year CD ladder would yield 5.24%. Or you could just put it in SWVXX which is currently yielding 4.96%.

Not a Schwab customer, but Fidelity has a similar mechanism. I'll check it out.

What is Fidelity mechanism?

Fidelity has an online tool for setting up a CD ladder or bond ladder such as with treasuries. It’s on their fixed income page.

Similar threads

- Replies

- 12

- Views

- 913

- Replies

- 33

- Views

- 2K

- Replies

- 17

- Views

- 778

- Replies

- 6

- Views

- 467