Best Options for Paying for a Vacation/Second Home

I would like to know what the best options are for paying for a vacation/second home. Specifically, would using a HELOC with a combination of personal cash be the best option to pay for a second home. Another option would be put down x amount of cash (40%) and then finance the rest.

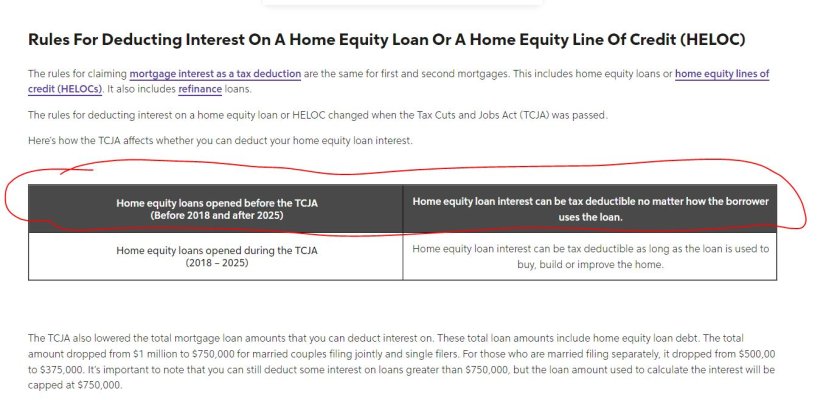

If a HELOC is used, is the interest on the HELOC tax deductible if you use the funds to purchase a vacation/second home?

Would love to hear from others that has purchased a vacation home.

Thanks

I would like to know what the best options are for paying for a vacation/second home. Specifically, would using a HELOC with a combination of personal cash be the best option to pay for a second home. Another option would be put down x amount of cash (40%) and then finance the rest.

If a HELOC is used, is the interest on the HELOC tax deductible if you use the funds to purchase a vacation/second home?

Would love to hear from others that has purchased a vacation home.

Thanks

Last edited: