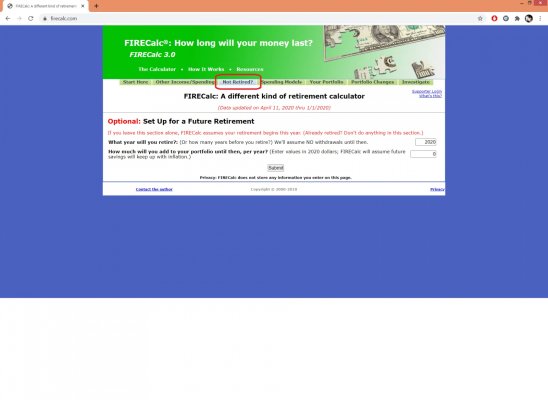

If I want to retire in the next couple of years, but can't touch 401K/IRA funds for another ~ten years, what's the best way to use FIRECalc to help with some analysis?

From what I could discern, FIRECalc starts taping portfolio immediately upon retirement.

I've played with the numbers/settings a bit, but I'd like to use existing portfolio, with modest additional savings, but not start withdrawals for a while.

I think I might be missing or misunderstanding a setting on how to do something like this.

I have a military pension and VA disability that covers about 70% of expenses until I can start withdrawals. May work part time to bridge gap until 401K/IRA access.

From what I could discern, FIRECalc starts taping portfolio immediately upon retirement.

I've played with the numbers/settings a bit, but I'd like to use existing portfolio, with modest additional savings, but not start withdrawals for a while.

I think I might be missing or misunderstanding a setting on how to do something like this.

I have a military pension and VA disability that covers about 70% of expenses until I can start withdrawals. May work part time to bridge gap until 401K/IRA access.