I went over to the tax calculator at

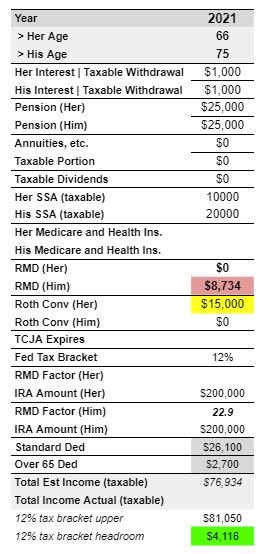

https://www.dinkytown.net/java/1040-tax-calculator.html and made a few guesses at your numbers. If you are still in the marginal 12% this year, I believe you are getting close to the top of that bracket. With two pensions, two SS checks and one RMD you're probably soon entering the 22% bracket. If you focus on just that calculator it will give you all you need to know about what to do this tax year 2021 as far as converting 403(b) to Roth IRA. If you and DH work on this together I know it will help you greatly, even if just to validate what a paid adviser comes up with later.

When you go to the calculator it has pre-filled data for a single person. You need to go through each expandable section and make changes to all of the boxes so it fits your profile.

If my estimates are correct, you may soon enter the 22% bracket. And of course it is inevitable that one of you will end up in the 24% bracket (as a single filer). So anything you can convert to Roth while in the "12" is a gain for you for the rest of your years.

As you can see from the depth of some posts here this is an elephant of a topic. You can't eat it all at one time, but a decent tax CPA or tax preparer can work this out for you, maybe make a simple table for the next 7 years or so. Of course the tax situation can change, and the projection won't be accurate each year, but it could be worth the effort.