Hi All

Does this indirect 60-day 401k rollover to Roth IRA break any IRS rules?

Specifically, does it break any IRS rules if:

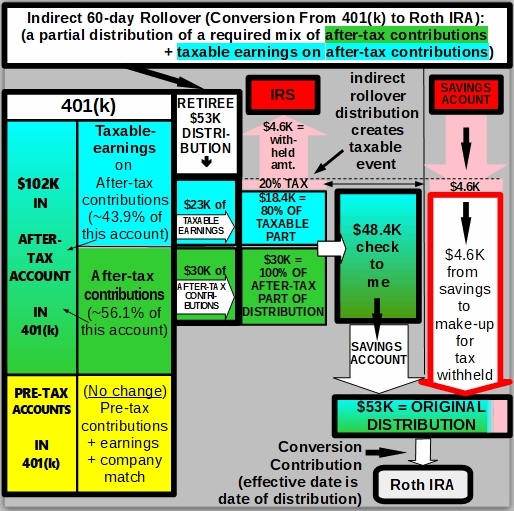

Here's a picture of the generic situation:

Any insights would be greatly appreciated!

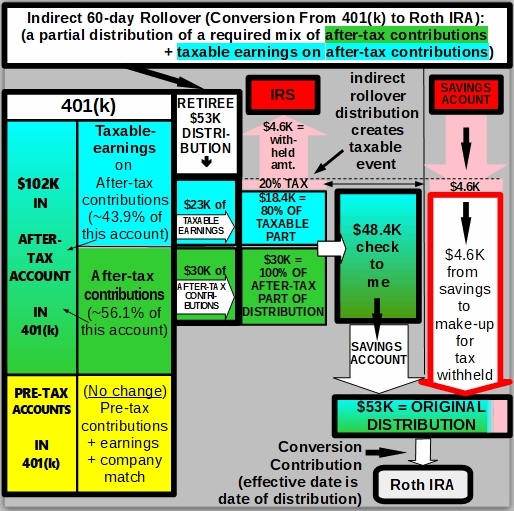

Does this indirect 60-day 401k rollover to Roth IRA break any IRS rules?

Specifically, does it break any IRS rules if:

- The 60-day rollover check is cashed before put into the Roth IRA?

- The rollover comes from 401k “after-tax account” contributions and taxable-earnings on those after-tax-contributions?

(NOT From a 401k Designated Roth Account. It’s just a regular 401k that also has a separate account for “after-tax-contributions” and their taxable earnings.)

- The IRS rollover chart does NOT list “after-tax” as an allowed rollover?

https://www.irs.gov/pub/irs-tege/rollover_chart.pdf

- The 20% withholding is “made-up-for" by taking money from a savings account so the amount being rolled over is the same as the 401k withdrawal distribution amount?

Here's a picture of the generic situation:

Any insights would be greatly appreciated!